Introduction

Who is the manufacturer of nicotine in India?

This is not just a curiosity-driven question—it is a commercial sourcing question asked daily by pharmaceutical buyers, e-cigarette manufacturers, agrochemical companies, and global distributors looking for reliable, GMP-compliant nicotine suppliers.

India has emerged as a strategic global hub for manufacturing and exports, supplying pharmaceutical-grade and industrial-grade nicotine to regulated and semi-regulated markets worldwide. With cost-efficient production, scalable capacity, and strong export compliance, Indian manufacturers are increasingly preferred by international buyers seeking long-term supply contracts.

This article delivers nicotine export data of India, identifies leading manufacturers, answers which country buys most and clarifies what country is number 1 import —all with a purely commercial and transactional lens.

Global Export Landscape: Scale, Participants, and Market Momentum

India’s export market features an active network of 89 unique exporters reaching out to 400 different importing entities worldwide, illustrating a broad and diversified trade ecosystem. Over a recent five-year stretch, the annual export volume has shown substantial growth, reaching approximately 456 metric tons in 2024 with revenue nearing $40.04 million USD. The expanding volume and increasing revenue reflect continued global demand and market momentum for nicotine exported from India.

India is not an occasional supplier—it is a core global nicotine sourcing destination.

The steady rise in export volume reflects long-term purchase agreements, repeat buyers, and strong international confidence in Indian manufacturers.

Leading Exporting Companies Worldwide

The following companies dominate export shipments and international buyer contracts:

- NICO ORGO MARKETING PVT LTD

- ALCHEM INTERNATIONAL PVT LTD

- BGP HEALTHCARE PVT LTD

- QUAD LIFESCIENCES PVT LTD

- INDIA GLYCOLS LTD

For international buyers, sourcing decisions are driven by cost predictability, regulatory readiness, and supply continuity. India meets all three criteria, making it a preferred origin for nicotine procurement. These manufacturers operate with export-focused infrastructure, catering to bulk buyers across pharmaceuticals, vaping, agrochemical intermediates, and chemical synthesis industries.

For international buyers, these companies offer:

-

-

- Contract manufacturing

- Bulk shipment capability

- Long-term supply agreements

- Compliance-ready documentation

-

Unlike smaller producing regions, Indian manufacturers are structured to support long-term B2B relationships, not just short-term trading. This makes India an ideal sourcing base for companies seeking consistency across multiple markets.

Key Importing Entities Fueling Global Demand

-

-

- AIRPHARM SA

- NICOTINE RIVER

- CHEMNOVATIC SP ZOO SP K

- NICTON LLC

-

These companies source nicotine at scale for:

- Vape and inhalation products

- Pharmaceutical formulations

- Chemical processing applications

For Indian exporters, these buyers represent long-term revenue stability rather than one-off shipments.

Top Destination Countries for Nicotine Exports

India exports nicotine and tobacco-based extracts to North America, Europe, and Eurasia, with strong penetration in regulated markets.

| Country | Volume (MT) | Revenue (USD) | Price per kg (USD) |

|---|---|---|---|

| Poland | 812.156 | 80,483,139.98 | 99.10 |

| United States | 1,020.866 | 149,672,925.99 | 146.61 |

| Switzerland | 721.638 | 99,540,717.38 | 137.94 |

| Russia | 325.167 | 35,109,987.48 | 107.98 |

| Ireland | 178.682 | 15,372,548.94 | 86.03 |

10-Year Export Volume and Value Trend Analysis

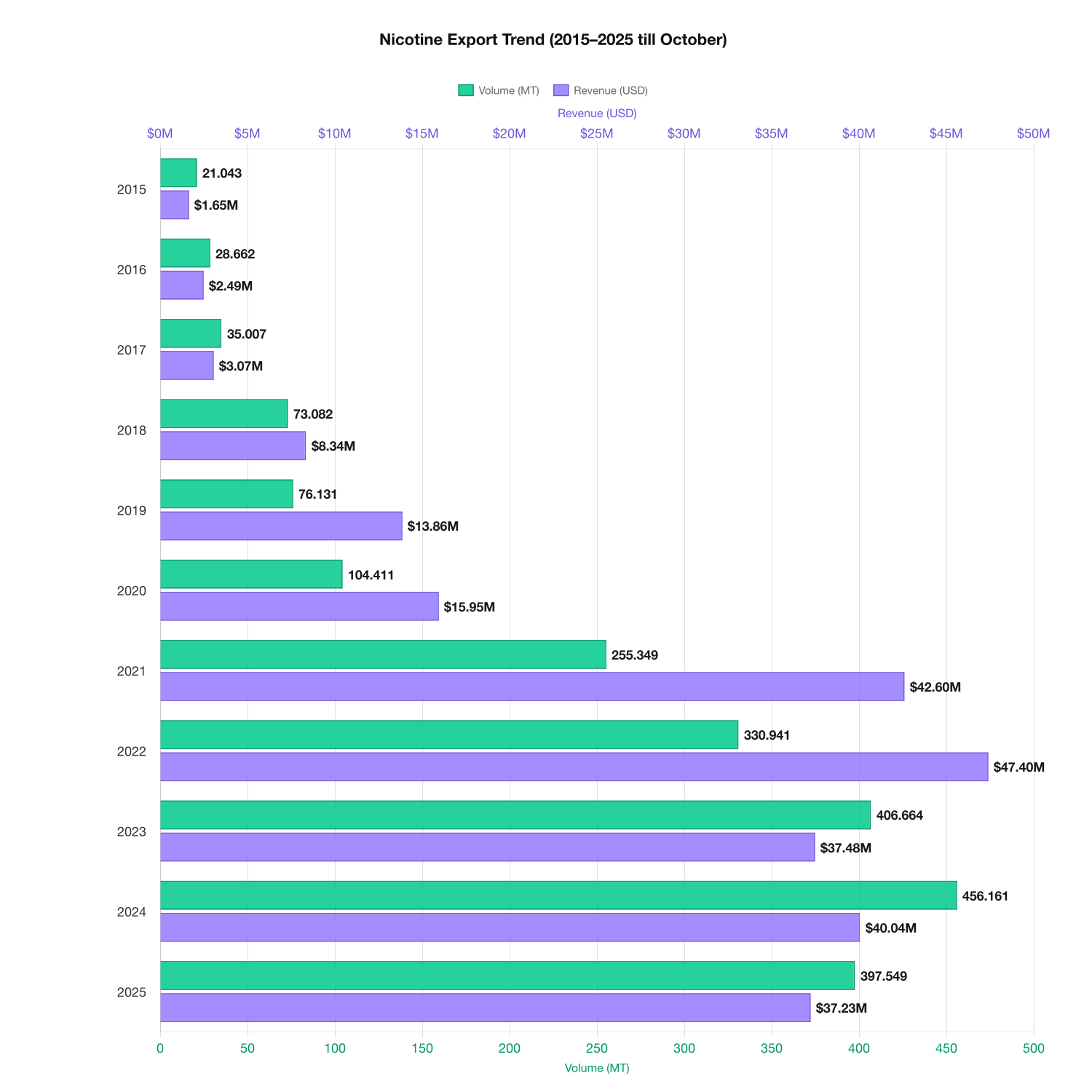

Examining the 10-year export trend from India, we see a steady growth from 2015, where exports began at approximately 21 metric tons generating revenue around $1.65 million USD. The volume peaked in 2024 at about 456 metric tons with a revenue just over $40 million USD, reflecting a robust expansion. Notably, a significant revenue spike appeared in 2021 reaching over $42 million while volumes exceeded 255 metric tons, denoting a phase of accelerated market growth.

Pricing Dynamics and Market Volatility

The price per kilogram has exhibited notable fluctuations over the past decade. Starting at approximately $78.48 per kg in 2015, prices rose to a peak of around $182.11 per kg in 2019. This peak may coincide with regulatory or global market influences, although no specific regulatory events are indicated in the data. Subsequently, prices moderated to about $87.78 per kg by 2024, suggesting market stabilisation with volatility driven by supply-demand dynamics across different years.

From a transactional standpoint, pricing is rarely negotiated per shipment alone. Most international buyers engage Indian suppliers through annual or multi-year supply contracts.

Commercial terms typically include:

-

-

- Minimum Order Quantities (MOQ) based on shipment frequency

- Quarterly or annual price benchmarking linked to raw material indices

- Dedicated production slots for repeat buyers

- Custom documentation support for destination-specific regulations

-

These arrangements help buyers hedge against short-term price volatility while ensuring uninterrupted access to supply.

HS Code Classification and Trade Compliance

India’s exports primarily fall under HS Code 51, with a cumulative volume of approximately 1,373 metric tons and a total value of about $136.76 million USD over the analyzed period. The average price per kilogram for this HS classification is near $99.60 USD. Compliance with international trade and pharmaceutical manufacturing standards is critical, and exporters often align with guidelines from authoritative agencies such as the World Health Organization (WHO) and the International Council for Harmonisation (ICH) to ensure product quality and regulatory adherence.

Emerging Opportunities and Strategic Market Entry Pathways

Among the top destination countries, Poland and Russia display significant volumes indicating growing demand, presenting promising opportunities for Indian exporters. To successfully enter and expand in these markets, adherence to regulatory frameworks such as FDA import guidelines available at the U.S. Food and Drug Administration (FDA) and manufacturing practices governed by the European Medicines Agency (EMA) are essential. These resources provide pathways to navigate legal and quality requirements effectively.

Conclusion: The Future Trajectory of Nicotine Trade (2025–2030)

Analyzing data from 2015 through 2025, India’s export market is robust with expansive volume growth, diversified trade relationships, and a stable pricing environment after certain fluctuations. With a healthy base of exporters and global importers, India is positioned to continue as a critical nicotine supplier. The steady revenue increase and evolving demand across major countries forecast a promising but competitive landscape. Realistic projections suggest continuity in volume growth with potential moderate price stabilization influenced by global economic conditions and regulatory environments.

For stakeholders, understanding “who is the manufacturer of nicotine in India?” alongside comprehensive trade data offers crucial insights for strategic decisions in sourcing, investment, and regulatory compliance within the nicotine pharmaceutical and chemical chemical supply chain.

Additional insights and data can be further explored through reliable trade databases such as UN Comtrade and supplemented by regulatory perspectives from global health authorities to align with best industry practices worldwide.

Unlock Live Nicotine Import Intelligence

Monitor real-time Nicotine trade flows, verify certified suppliers, and benchmark pricing across 100+ global markets with precision-grade intelligence for pharmaceutical procurement teams.