Sorbitol — a versatile sugar alcohol widely used in pharmaceuticals, food, cosmetics, and healthcare industries — is at the centre of India’s thriving API and chemical export ecosystem. As a multi-functional ingredient offering humectant, stabilizing, and non-carcinogenic properties, Sorbitol has transformed into one of the most valuable chemical commodities for both domestic and international markets.

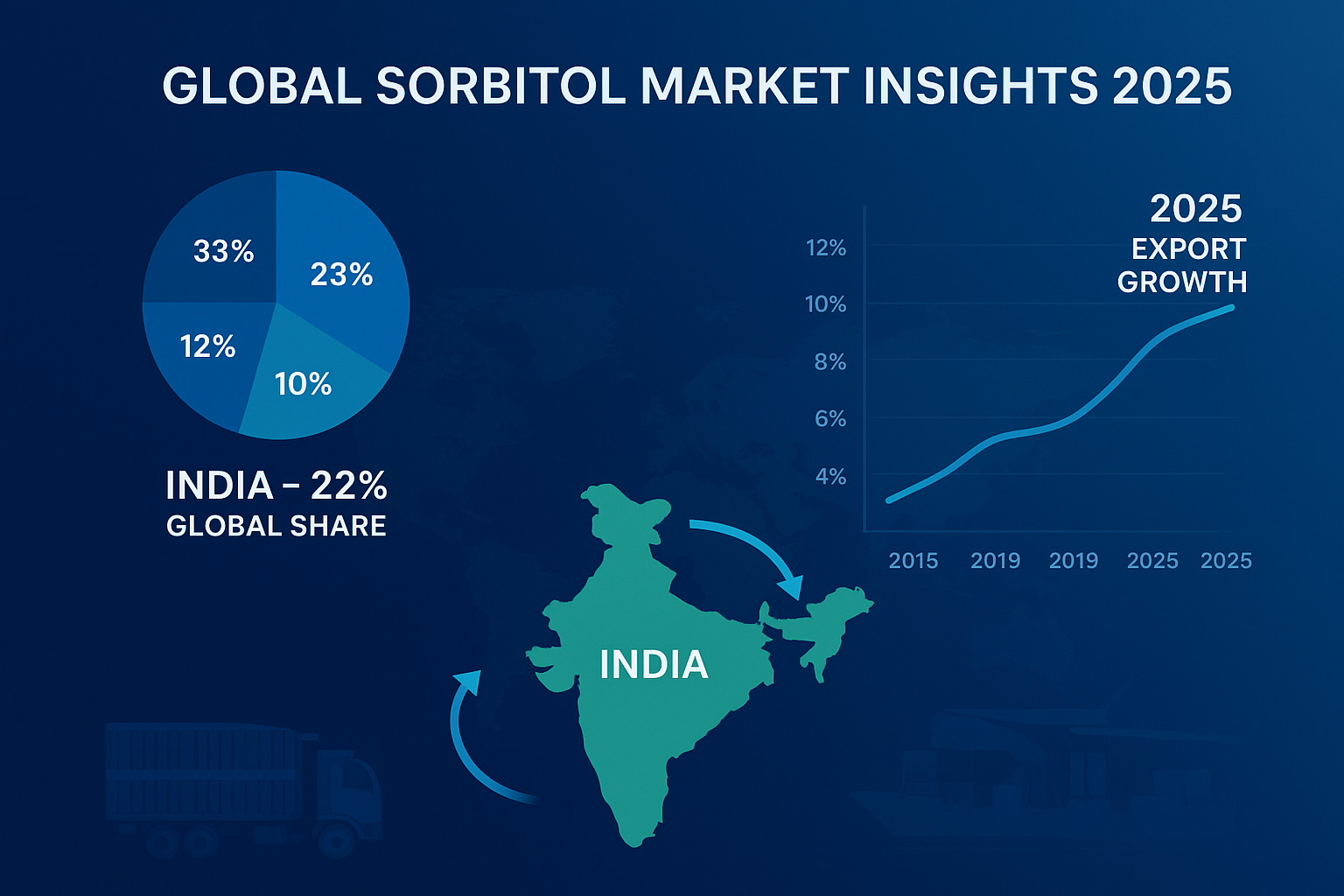

Over the past decade, India has emerged as one of the world’s largest producers and exporters of Sorbitol, leveraging its advanced chemical manufacturing infrastructure, skilled labor force, and strong global trade ties. With more than 576 export-oriented companies and 282 import-driven entities actively engaged in the trade, India’s polyols market has become a benchmark for quality, scale, and reliability in the global chemical supply chain.

From oral syrups and vitamin-C intermediates to confectionery, personal care, and nutraceutical formulations, Sorbitol’s wide applicability makes it an indispensable compound in modern industry. According to industry reports from Grand View Research, global Sorbitol demand is expected to grow at a CAGR of 5.8% between 2025 and 2030, positioning India as a key export hub for both bulk and specialty grades.

For broader industry validation, refer to WHO’s Pharmaceutical Excipients Report and ScienceDirect’s overview on Sorbitol applications.

Global Sorbitol Trade Overview and India’s Strategic Role

India’s dominance in polyol and sugar alcohol production is underpinned by world-class facilities in Gujarat, Maharashtra, and Madhya Pradesh. These clusters house advanced stainless-steel reactors, quality-control labs, and GMP-certified units that produce high-purity Sorbitol aligned with international pharmacopeia standards such as IP, BP, and USP.

Derived primarily from glucose, polyols serves as a low-calorie sweetener, humectant, and stabilizer in pharmaceutical, food, and cosmetic applications. Its functional versatility allows it to replace glycerol or sucrose in formulations, offering cost and performance benefits.

According to UN Comtrade’s trade database, India exported approximately 115,462,130 kilograms of Sorbitol in 2024, generating nearly USD 64.1 million in revenue. The UAE, Brazil, Iraq, South Africa, and Russia were among the top five destinations, representing a combined share of over 40% of total export volume. The UAE remains India’s most stable trade partner, importing over 18.4 million kg at an average price of USD 0.54/kg.

| Country | Export Quantity (kg) | Average Price (USD/kg) |

|---|---|---|

| UAE | 18,410,753 | 0.54 |

| Brazil | 5,001,909 | 0.57 |

| Iraq | 1,597,800 | 0.55 |

| South Africa | 839,100 | 0.56 |

| Russia | 10,727,159 | 0.54 |

These numbers highlight India’s strong integration into global value chains. Moreover, trade agreements like the India–UAE Comprehensive Economic Partnership Agreement (CEPA) are expected to further enhance bilateral trade efficiency and tariff advantages for chemical exports.

Top Exporters and Importers Driving the Sorbitol Market

India’s polyols landscape is shaped by a few dominant players with advanced production capabilities and global supply chains. Leading manufacturers such as Gulshan Polyols Ltd, Gujarat Ambuja Exports Ltd, Kasyap Sweeteners Ltd, and Sayaji Industries Ltd contribute over 60% of total exports.

These companies not only cater to bulk industrial demand but also meet high-quality specifications for pharmaceutical-grade Sorbitol used in APIs, excipients, and medical formulations. Their commitment to innovation, capacity expansion, and R&D collaboration with international buyers ensures India’s long-term export sustainability.

| Company Name | Specialization |

|---|---|

| Gulshan Polyols Ltd | Pharma-grade and industrial Sorbitol, starch derivatives |

| Gujarat Ambuja Exports Ltd | API-grade Sorbitol for pharmaceuticals and food |

| Kasyap Sweeteners Ltd | High-purity Sorbitol and liquid polyols |

| Sayaji Industries Ltd | Maize-derived Sorbitol and specialty starches |

| Prakash Chemicals International Pvt Ltd | Distribution of specialty Sorbitol formulations |

On the import side, Indonesia and France dominate India’s inbound polyols trade. Suppliers such as PT Sorini Agro Asia Corporindo and Roquette Frères provide specialized, high-grade polyols catering to pharma and cosmetic formulations. Imports from France average around USD 7.47/kg, reflecting premium-grade quality.

Industry analysts from IBEF and Trade.gov emphasize that such dual sourcing helps Indian manufacturers balance cost efficiency with product diversity, strengthening India’s export resilience.

Year-wise Trade Data and Export Trend Analysis

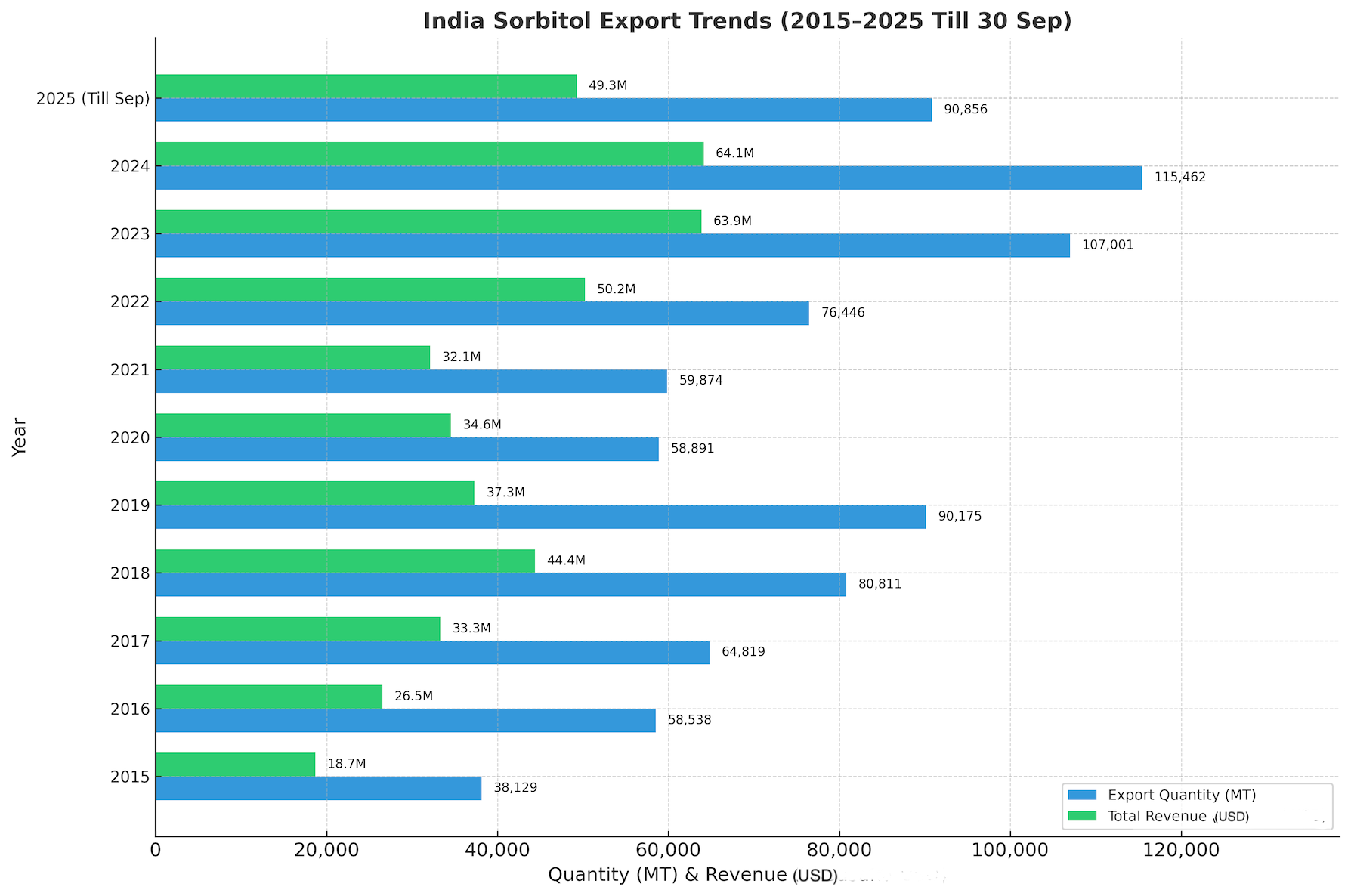

Between 2015 and 2025, India’s Sorbitol exports grew from 38 million kilograms to over 115 million kilograms, marking a compound annual growth rate of nearly 12%. This growth trajectory demonstrates India’s sustained leadership in low-calorie polyol exports, supported by technological advancement and consistent demand across international markets.

Despite moderate price corrections in 2025, average export prices remain competitive between USD 0.54–0.60/kg. These prices highlight India’s operational efficiency, cost-effective logistics, and strong supplier relationships. The slight dip in exports for 2025 (till September) is attributed to cyclical inventory adjustments in destination countries like the UAE and Russia.

Analyst Note: The market’s resilience is evident in its ability to maintain consistent volume even amid freight fluctuations and regulatory shifts. Sorbitol remains a core excipient for drug manufacturers and a sustainable alternative for food and personal care brands seeking bio-based ingredients.

Market Forecast and Future Outlook (2025–2030)

As we move through 2025 and beyond, India’s polyols export ecosystem is expected to strengthen with greater adoption in pharmaceutical excipients, oral care formulations, and nutraceutical products. Demand for bio-based and GMO-free Sorbitol is also set to rise in line with global sustainability mandates.

Several companies, including Gulshan Polyols and Sayaji Industries, have announced capacity expansions and technological upgrades aimed at boosting high-purity polyols production. This will support India’s compliance with stricter EU and US FDA norms for pharmaceutical-grade polyols.

According to Statista’s 2025 Chemical Industry Outlook, India’s chemical exports are projected to exceed USD 120 billion by 2030, with polyols being a key growth segment. The export volume of Sorbitol alone is expected to remain above 90 million kilograms annually, generating over USD 50 million in consistent trade value.

Strategic Takeaways:

- Pharmaceutical-grade polyols will remain a high-demand export category through 2030.

- Middle East, Africa, and Latin America continue as key trade corridors.

- Bio-based production and green manufacturing will enhance India’s export credibility.

- Regulatory partnerships and quality certifications will define future competitiveness.

Expanding Applications Across Industries

While pharmaceuticals remain the backbone of Sorbitol demand, several emerging industries are driving new consumption trends. In the food and beverage sector, Sorbitol is increasingly used in sugar-free chewing gums, diabetic confectionery, and low-calorie syrups due to its non-cariogenic and humectant properties. Leading FMCG companies are replacing artificial sweeteners with Sorbitol to appeal to health-conscious consumers.

In the personal care and cosmetics industry, Sorbitol functions as a key moisturizing agent in lotions, toothpaste, and creams. Its compatibility with natural and herbal formulations makes it ideal for eco-conscious brands targeting global markets.

Meanwhile, the industrial and textile sectors utilize Sorbitol as a finishing and softening agent, improving fabric quality and durability.

The pharmaceutical API market continues to depend heavily on polyols as a stabilizer and bulk excipient in oral and injectable drug formulations. Its superior physicochemical stability under diverse conditions reinforces its utility in complex formulations, especially for vitamin-C production and IV solutions.

Conclusion: The Road Ahead for India’s Sorbitol Market

India’s polyols market exemplifies the nation’s capability to merge industrial scale with chemical innovation. From small-scale refineries to world-class manufacturing plants, Indian exporters are redefining global standards of consistency, purity, and sustainability. With growing demand from pharmaceuticals, FMCG, and food industries, Sorbitol’s role in global trade will continue to expand.

By focusing on bio-based innovation, sustainable sourcing, and digital trade analytics, India is poised to retain its leadership in the global polyols export landscape. As international markets seek reliable suppliers for excipient-grade ingredients, Indian companies are well-positioned to deliver both volume and value.

Explore Real-Time Sorbitol Trade Insights

Discover how India’s Sorbitol API exports are shaping global markets. Access live dashboards, analyze trade volumes, and explore market trends with our API FDF data intelligence platform.

Want to get similar data-backed insights? Try our platform today and unlock full market visibility.