The global healthcare ecosystem in 2024 is defined by the resilience and diversity of Finished Dosage Forms (FDFs), which are the patient-ready medicines, medical devices, and health products that drive clinical outcomes worldwide. The industry is witnessing a significant shift towards high-value biologics and specialty generics, coupled with sustained high-volume demand for essential medicines. This updated review explores the export–import footprint, supplier base, market dynamics, and strategic relevance of the top FDF categories shaping global trade in 2024 — with a focus on market value, unit economics, and emerging product segments.

Market Overview: The FDFs Driving Modern Healthcare & Global Trade

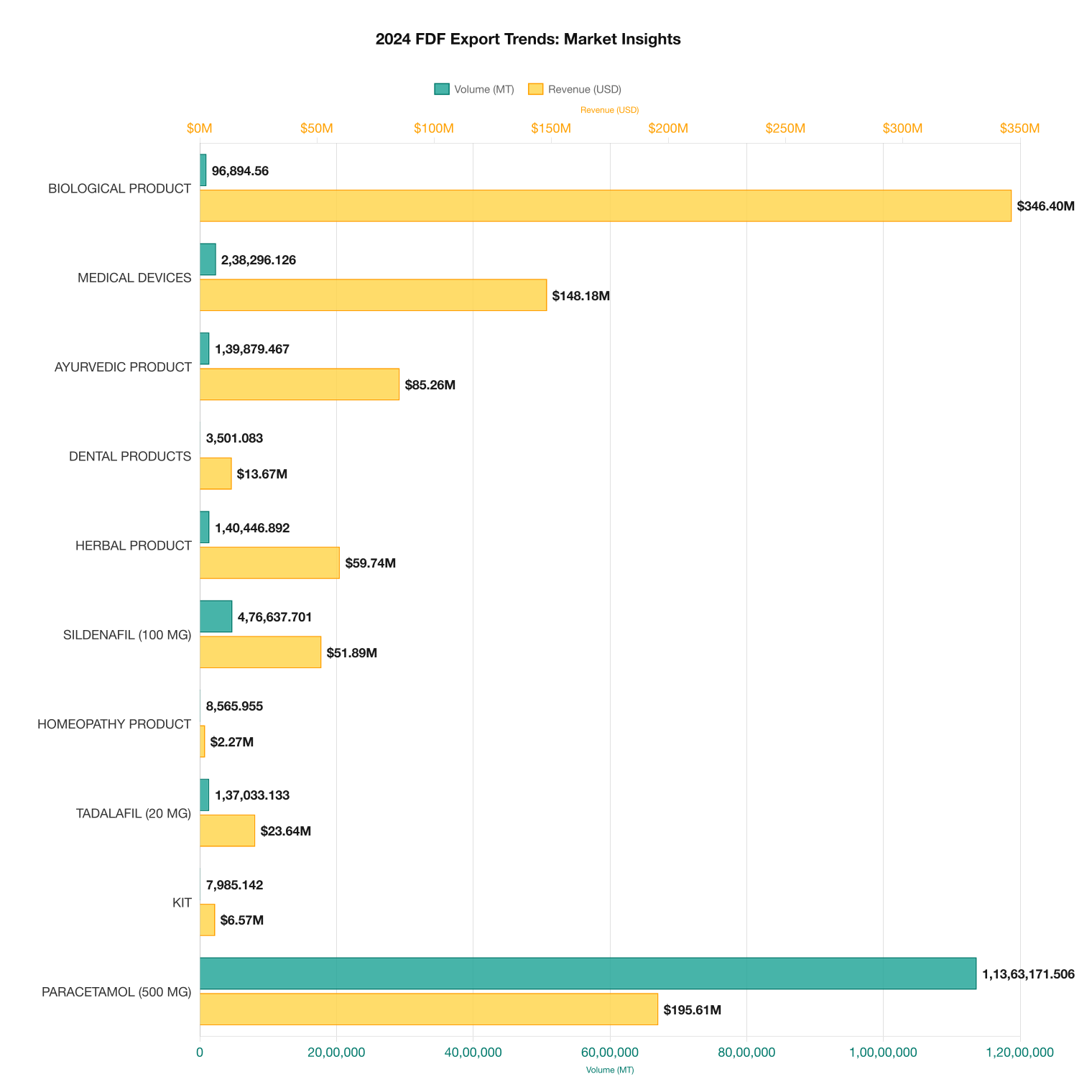

Global demand for FDFs is bifurcated between high-cost, high-value Biologics and Medical Devices and high-volume, low-cost generics like Paracetamol and Metformin. Data from 2024 trade registries highlight the growing importance of specialized segments such as Dental Products (commanding a high average price) and the massive volume of essential oral solids like Sildenafil and Tadalafil. These Finished Dosage Forms are the frontline products ensuring patient access and driving pharmaceutical revenue worldwide.

India continues to reinforce its role as the “Pharmacy of the World,” leveraging its vast manufacturing scale, expertise in oral solids, and growing capabilities in complex formulations and biosimilars. The country’s influence is particularly evident in high-volume generic drug shipments, which are crucial for global health security and cost-effective treatment across developing nations.

In 2024, the global healthcare market is driven by Finished Dosage Forms (FDFs) — patient-ready medicines and health products essential for clinical care. The sector is shifting towards biologics and specialty generics, while demand for essential medicines remains strong. This review covers the export-import trends, supplier landscape, and key market drivers of leading FDF categories, supported by data from customs and verified sources like the UN Comtrade Database.

Finished Dosage Forms (FDFs) & Products — Detailed Profile Analysis

Below is an in-depth profile of the most actively traded FDF products and categories of 2024, showing their market scale, supplier base, and unit economics.

1. BIOLOGICAL PRODUCT — The High-Value Growth Segment

Biological Products lead the market by value, supported by 2,909 exporters and 10,226 importers. In 2024 shipment data shows a total trade value of $346.40 Million across 96.89 Million kg, averaging a premium price of $3.58 per kg.

Market Characteristics:

- Highest trade value segment, reflecting premium pricing and complex manufacturing.

- High number of importers signals global adoption of vaccines, hormones, and proteins.

- Growth driven by advancements in biotech and monoclonal antibodies.

2. MEDICAL DEVICES — The Segment with the Widest Global Reach

Medical Devices demonstrate the widest trade footprint with 5,711 exportersand 18,675 importers. In 2024, it recorded a total trade value of $148.18 Million across 238.30 Million kg, averaging a low-cost volume price of $0.62 per kg.

Market Behavior:

- Highest number of global trade partners (exporters and importers).

- Low average price per kg indicates mass-volume, disposable, and general-purpose items.

- Essential for healthcare infrastructure and diagnostics globally.

3. PARACETAMOL (ACETAMINOPHEN) (500 MG) — The Massive Volume Generic

Paracetamol (500 MG) is a high-volume essential medicine, supported by 1,494 exporters and 4,670 importers. 2024 data a massive volume of 11,363.17 Million kg traded for a value of $195.61 Million, resulting in an extremely low average price of $0.02 per kg.

Market Trends:

- One of the lowest unit prices, indicative of commodity generic status.

- Trade volume (11.3 Billion kg) dominates all other products, highlighting essential global demand.

- Strong, established generic supply chain from key manufacturing hubs.

4. METFORMIN (500 MG) — Essential Diabetes Management Drug

Metformin (500 MG) is critical for diabetes care, supported by 1,083 exporters and 2,778 importers. Shipments totaled $144.38 Million across 8,371.61 Million kg, with an average price of $0.02 per kg.

Market Dynamics:

- Similar ultra-low unit price and high volume as Paracetamol, driven by chronic disease burden.

- Highly consolidated generic supply chain.

- Demand is stable and non-cyclical, linked directly to global diabetes rates.

5. AYURVEDIC PRODUCT — Expanding Complementary Medicine Segment

Ayurvedic Products have a substantial trade presence with 5,825 exporters and 15,889 importers. In 2024, total shipments reached $85.26 Million across 139.88 Million kg, averaging $0.61 per kg.

Market Trends:

- Remarkably high number of exporters and importers, suggesting fragmented, diverse supply chain.

- Mid-range average price per kg, higher than basic generics but lower than biologics.

- Growing consumer trend towards natural and complementary medicines.

6. HERBAL PRODUCT — Low-Cost, Broad-Market Complementary Medicine

Herbal Products are also widely traded, supported by 4,574 exporters and 10,937 importers. 2024 data reveals $59.74 Million traded over 140.45 Million kg, averaging a low price of $0.43 per kg.

Market Characteristics:

- Extremely high volume and low price point within the complementary medicine category.

- Large supplier base indicates global sourcing of raw and processed herbal materials.

- Price sensitivity is high, making it a commodity-like segment.

7. SILDENAFIL (100 MG) — High-Volume Lifestyle Generic

Sildenafil (100 MG) retains strong global momentum with 1,693 exporters and 6,840 importers. 2024 shipments recorded $51.89 Million across 476.64 Million kg, with a very low average price of $0.11 per kg.

Market Characteristics:

- Very high volume and low price point, typical of an off-patent, high-demand product.

- Widespread adoption in both developed and developing markets post-patent expiry.

- High exporter/importer count suggests a deeply commoditized global market.

8. TADALAFIL (20 MG) — Key Companion Lifestyle Generic

Tadalafil (20 MG) is a key companion to Sildenafil, supported by 1,025 exporters and 2,875 importers. In 2024, total trade amounted to $23.64 Million across 137.03 Million kg, with an average price of $0.17 per kg.

Market Insights:

- Slightly higher unit price than Sildenafil, reflecting market positioning and volume difference.

- Concentration of trade partners is lower than Sildenafil, suggesting a more specialized supply chain.

- Stable demand for a long-acting oral solid dosage form.

9. DENTAL PRODUCTS — A High-Priced Specialty Segment

Dental Products show significant unit value, supported by 1,115 exporters and 3,115 importers. In 2024, it accounted for $13.67 Million in trade across a very low 3.50 Million kg, averaging a high unit price of $3.91 per kg.

Market Notes:

- Highest average price per kg among all non-Biologic categories, indicating specialized, high-precision materials/devices.

- Low volume suggests trade focuses on small, expensive, or highly specialized tools and materials.

- Demand is linked to global growth in elective and necessary dental procedures.

10. KIT — Diagnostic and Testing Segment

The KIT category, often comprising diagnostic or testing kits, shows steady activity with 546 exporters and 1,348 importers. In 2024, it totaled $6.57 Million in trade across 7.99 Million kg, averaging $0.82 per kg.

Market Evolution:

- Mid-range unit price, reflecting the value of packaged diagnostic components.

- A relatively smaller base of trade partners, suggesting a more concentrated supply market.

- Demand is continuously driven by point-of-care testing and decentralized diagnostics.

11. HOMEOPATHY PRODUCT — A Niche Global Segment

Homeopathy Products represent a niche market with 407 exporters and 894 importers. In 2024, it showed a trade value of $2.27 Million across 8.57 Million kg, averaging a low price of $0.27 per kg.

Market Characteristics:

- Lowest number of exporters and importers, confirming its niche status in global trade.

- Low unit price per kg, consistent with the nature of the product.

- Stable demand in countries where traditional medicine remains popular.

Global Trade Trends & Market Behavior in 2024

2024 shipment data for FDFs reveals a clear three-tier market structure: ultra-high value biologics, mid-value medical devices and specialty products, and ultra-high volume commodity generics.

While Biological Products drive the market by monetary value ($346.4M at $3.58/kg), the essential oral solids Paracetamol (11.3 Billion kg at $0.02/kg) and Metformin (8.3 Billion kg at $0.02/kg) represent the backbone of global pharmaceutical accessibility due to their immense volume and cost-effectiveness.

Procurement Strategy for 2024: How Buyers Should Navigate the Market

1. Value vs. Volume Sourcing Strategy

- High-Volume Generics (Paracetamol, Metformin): Focus procurement on long-term contracts, low-cost consolidation, and supply chain redundancy from major global generic hubs. Price sensitivity is paramount.

- High-Value Biologics (Biological Products): Prioritize cold-chain logistics, regulatory compliance (GMP, WHO), and supplier track record over minor price differences.

2. Niche & Specialty Products Offer Higher Margin Potential

- Dental Products and Medical Devices command higher unit prices; focus on quality certifications and technical specifications.

- Ayurvedic and Herbal Products should be sourced from regions with established quality control for natural formulations, leveraging their diverse supplier base.

3. Compliance and Traceability are Critical

- FDFs, being patient-ready, require complete traceability of APIs and Excipients.

- Ensure all manufacturers meet cGMP and stringent regulatory standards (FDA, EMA, WHO) to prevent costly recalls (e.g., as seen in the Sildenafil/Tadalafil generic market).

4. Inventory Planning Must Match Consumption

- Safety Stock is crucial for essential generics like Metformin to prevent stock-outs due to chronic demand.

- JIT (Just-in-Time) may be considered for high-turnover, low-cost consumables and less critical devices.

Conclusion: Strategic Role of Finished Dosage Forms in 2024

The FDF market in 2024 shows a robust, dual-track environment: innovation in high-value biologics and medical technology, balanced by the indispensable role of massive-volume generic medicines. This complexity demands sophisticated supply chain management that accounts for both regulatory stringency and volume economics.

For manufacturers and exporters in the FDF space, competitive advantage will be built upon:

- Mastering efficient, compliant, and cost-effective production of oral solids.

- Strategic investment in complex products (like Biologics and high-end devices).

- Maintaining full data integrity and traceability throughout the manufacturing process.

By effectively navigating these trade dynamics, the global FDF market will continue to be the primary engine for delivering essential and life-saving healthcare solutions to patients worldwide.

Optimize Your FDF Procurement with Proven Market Intelligence

Equip your team with precise demand trends, exporter depth, price movements, and compliance insights across all Finished Dosage Forms. This guide helps you assess supplier reliability, purity standards, and risk exposure—building stronger negotiations and resilient procurement pipelines.