Pick up any pill bottle in your medicine cabinet. It doesn’t matter if you bought it in New York, London, or Cape Town. There is a very high probability that the ingredient doing the actual work inside that tablet came from one place: India.

Most people focus on the brand name on the box. But industry insiders know the real story is about the Active Pharmaceutical Ingredient (API). This is the chemical compound that actually cures the headache or lowers the blood pressure.

When we talk about Pharma API exports from India, we aren’t just talking about chemicals. We are talking about the backbone of global healthcare.

Quick Answer: Why is India a Global Leader?

India dominates the API sector because it offers a perfect trifecta: volume, cost-efficiency, and strict regulatory compliance. The nation hosts the highest number of USFDA-approved plants outside the United States, allowing it to supply over 20% of the world’s generic medicines reliably and affordably.

- Volume: massive production capacity for generic drugs.

- Quality: Strict adherence to USFDA and EMA standards.

- Policy: Government incentives like the PLI scheme are boosting domestic production.

What Exactly Are APIs? (And Why Should You Care?)

Let’s strip away the jargon for a second. Think of a car. The brand might be Ford or Toyota, and the paint job looks nice. But without the engine, it’s just a metal shell.

The API is the engine.

In pharmaceutical terms, a medicine is made of two main parts:

-

- The API: The central ingredient (like Paracetamol or Ibuprofen).

- The Excipients: The inactive stuff that binds the pill together, gives it color, or helps it digest.

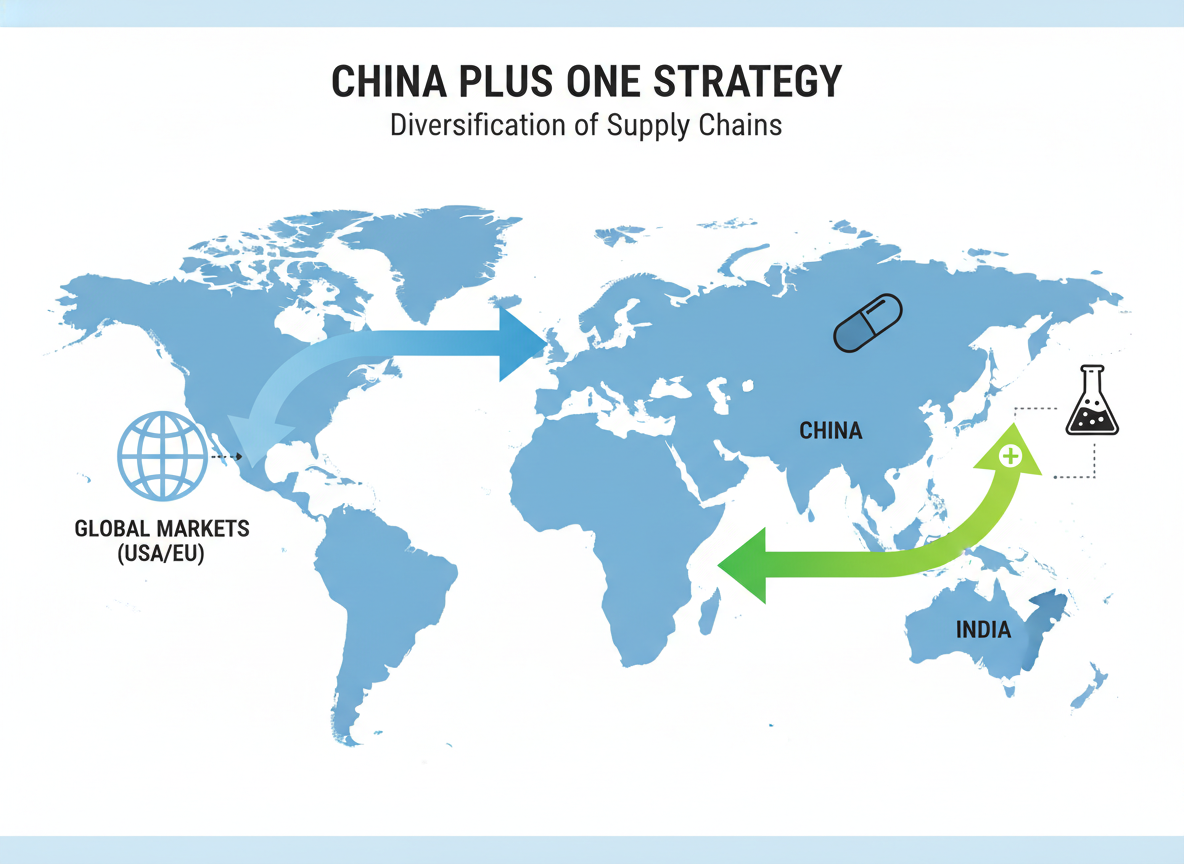

A clean, vector-style infographic showing the ‘China Plus One’ strategy. A map of the world highlights China and India. Arrows flow from Global Markets (USA/EU) diverging to connect to both China and India, with the Indian connection highlighted in green to show growth. Simple icons representing pills and chemical flasks.

Why does this distinction matter to a buyer or supply chain manager? Because sourcing the final formulation is easy. Sourcing high-quality, pure APIs is where the supply chain usually breaks.

If the API isn’t pure, the medicine doesn’t work. It’s that simple.

This is where Pharma API exports from India separate themselves from the pack. The focus isn’t just on making the chemical; it’s on making it pure enough to pass the world’s strictest safety tests.

The Numbers Don’t Lie: India’s Massive Global Footprint

You might have heard the phrase “Pharmacy of the World.” It sounds like a marketing slogan, but the data backs it up.

India is currently the third-largest producer of pharmaceuticals by volume globally. But the export numbers are even more telling.

We are seeing double-digit growth year over year. The demand isn’t coming from developing nations alone. The biggest buyers are actually the countries with the strictest regulations.

Here is a snapshot of where Indian APIs are going:

| Region | Market Share Impact | Primary Demand |

|---|---|---|

| North America (USA) | High (30%+) | Generics, Complex Generics |

| Europe | Moderate-High | Specialty APIs, Oncology |

| Africa | High | Anti-infectives, Antivirals |

| Latin America | Growing Rapidly | Biosimilars, Standard Generics |

The United States is the largest export destination. Think about that. The country with the FDA—the toughest watchdog in the world—relies heavily on Indian manufacturers.

If you need more details on specific market trends, check out our report on global pharma supply chains.

Why the World Chooses Indian APIs

So, why India? Why not source from elsewhere?

It usually comes down to three factors. If you are a procurement manager, these are the only three things you care about.

1. The Cost Advantage

Manufacturing in India is roughly 33% cheaper than in the US. This isn’t just about cheap labor. It’s about process engineering. Indian engineers are masters at finding more efficient ways to synthesize chemicals without breaking the bank.

2. The Brain Power

India churns out thousands of chemical engineers and pharmacists every year. You have a highly skilled workforce that speaks English and understands global compliance standards. You don’t get that everywhere.

3. The Compliance Factor

This is the big one. India has over 600 USFDA-approved facilities. That is more than any other country outside the US. When you buy Pharma API exports from India, you aren’t gambling on quality. You are buying from a factory that gets inspected by American regulators regularly.

The ‘China Plus One’ Strategy Explained

We have to talk about the elephant in the room: China.

For decades, China dominated the raw material market. They controlled the Key Starting Materials (KSMs). But then the pandemic hit.

Supply chains froze. Borders closed. Factories shut down.

Global pharma companies panicked. They realized they were too dependent on one single source. What happens if that source turns off the tap?

Enter the “China Plus One” strategy.

Companies decided they needed a backup. They needed a second major hub to mitigate risk. India was the natural choice. It already had the factories, the talent, and the regulations in place.

This shift isn’t temporary. It is a structural change in how the world buys medicine. Companies are moving contracts to India to ensure they never run out of stock again.

Government Push: The PLI Scheme Impact

The Indian government saw this opportunity and grabbed it.

They introduced the Production Linked Incentive (PLI) scheme. It’s a boring name for a very exciting concept.

Basically, the government pays manufacturers to make things in India. But there is a catch. They have to make the KSMs—the raw ingredients that India used to import from China.

The goal is total self-reliance. By reducing import dependence for these starting materials, Pharma API exports from India become bulletproof. External geopolitical shocks won’t hurt production.

According to recent industry reports, this scheme is expected to generate billions in additional export revenue by 2025 (Source: IBEF).

Looking Ahead: 2025 and Beyond

The trajectory is clear.

India is moving up the value chain. It used to be about simple, high-volume generics. Now, Indian companies are targeting complex molecules, biosimilars, and specialty drugs.

The buyers are ready. The factories are ready. The government is backing it.

For anyone involved in the pharmaceutical supply chain, looking at India isn’t an option anymore. It’s a necessity.

Ready to Secure Your Supply Chain?

Navigating the world of API sourcing can be a headache. You need a partner who understands the regulations, the chemistry, and the logistics.

Don’t leave your supply chain to chance. See how our platform connects you with verified manufacturers instantly.