Amoxicillin exports from India represent a critical sourcing channel for pharmaceutical importers, distributors, formulation manufacturers, and procurement teams seeking dependable antibiotic suppliers. As one of the most widely prescribed beta-lactam antibiotics worldwide, Amoxicillin continues to experience sustained demand across both regulated and semi-regulated markets, driven by its proven efficacy, broad therapeutic applications, and inclusion in essential medicine lists across multiple countries.

Between 2015 and 2025, India strengthened its position as a leading global supplier of Amoxicillin APIs, supported by high-volume manufacturers such as Aurobindo Pharma, Medreich Ltd, and Medicef Pharma, which together accounted for a significant share of total export shipments. The supplier ecosystem is further reinforced by established pharmaceutical companies including Cipla, Sun Pharmaceutical Industries and Alkem Laboratories alongside specialized third-party manufacturers such as Addii Biotech. This diversified manufacturing base spans Amoxicillin Trihydrate and Amoxicillin–Clavulanic Acid formulations, ensuring consistent supply availability, competitive pricing, and compliance with global regulatory standards.

India’s export performance is underpinned by a well-developed logistics and port infrastructure. As of 2025, a substantial portion of Amoxicillin API shipments are routed through Nhava Sheva Sea Port (JNPT) and Bombay Air Cargo, which serve as the primary exit points for both bulk sea freight and time-sensitive air consignments. These ports enable efficient access to key destination markets across North America, Europe, the Middle East, Africa, and Southeast Asia, supporting faster turnaround times and reliable supply continuity.

As global buyers increasingly prioritize GMP-compliant, cost-efficient, and export-ready suppliers, Indian manufacturers continue to emerge as preferred sourcing partners, backed by scalable production capacity, a strong shipment track record, and proven reliability across international pharmaceutical supply chains.

Global Export Landscape: Scale, Participants, and Market Momentum

The global trade of this antibiotic combination is supported by a well-established and competitive supplier network, making it a strategically important sourcing category for pharmaceutical importers, formulators, and distributors. Over the past decade, 73 verified exporters have supplied material to 149 active import markets, demonstrating strong supplier depth, diversified origin options, and dependable global availability.

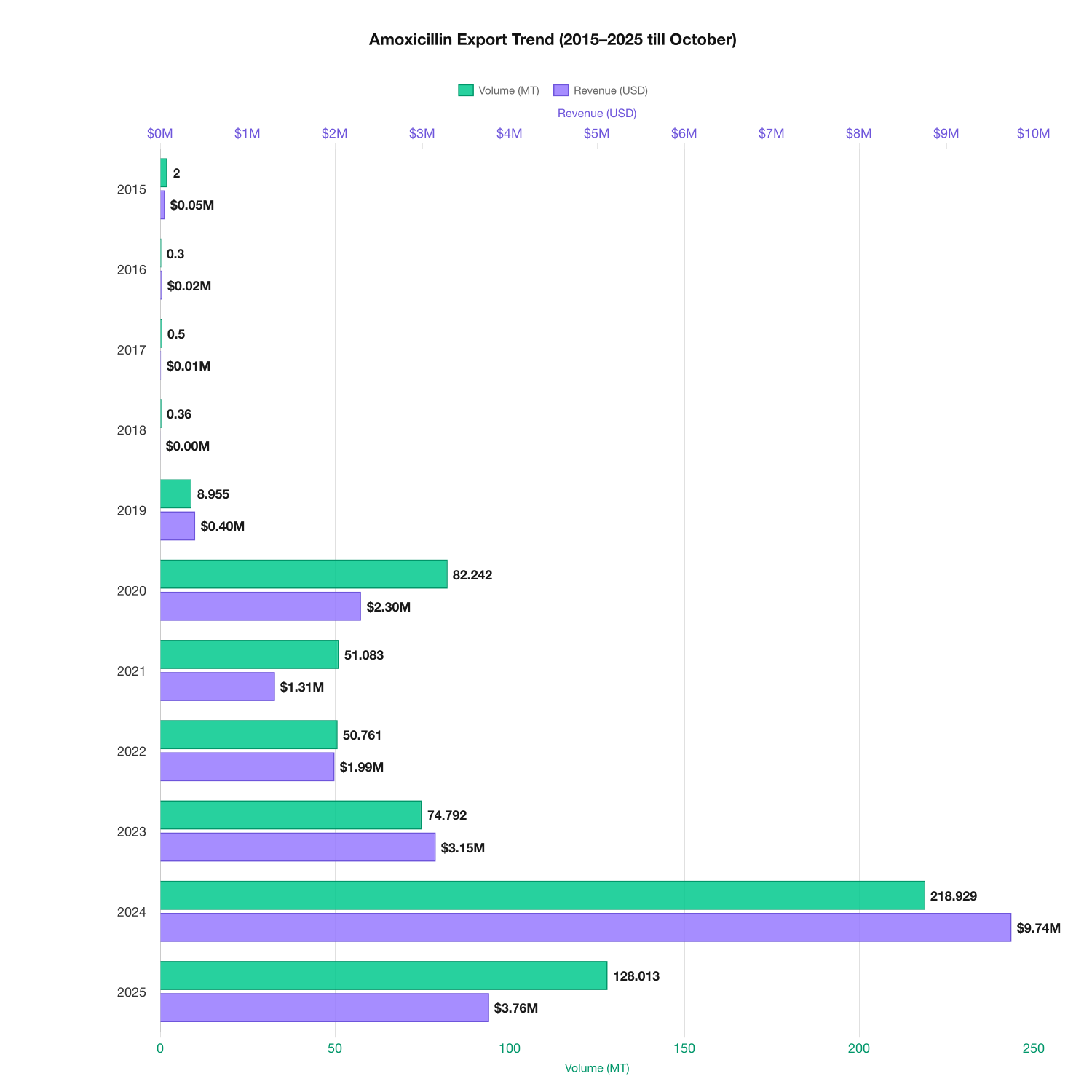

From 2015 to 2025, export performance reflects clear procurement-driven cycles. Shipments reached a temporary low in 2016 (300 kg), followed by sustained expansion as international buyers increased reliance on long-term API sourcing. Export volumes peaked in 2024 at 218,928 kg, while total export value rose sharply from approximately $15,844 in 2016 to nearly $9.74 million in 2024, underscoring rising contract volumes, pricing strength, and buyer confidence.

For procurement teams and market entrants, these trends signal stable demand, scalable supply, and proven trade liquidity. As antimicrobial resistance drives consistent therapeutic demand and healthcare systems expand access to antibiotics, this API category continues to offer commercially viable sourcing opportunities, supported by mature supply chains and predictable trade flows.

Key Manufacturers and Suppliers (2015–2025)

Several established pharmaceutical companies contribute to the manufacturing and global supply of this antibiotic combination. Key exporters include:

- MEDICEF PHARMA : Manufacturer and exporter of antibiotic APIs and formulations for emerging and semi-regulated markets.

- STERILE INDIA PVT LTD : Supplier of sterile APIs and pharmaceutical intermediates with regulated market exposure.

- PRIME PHARMACEUTICALS PVT LTD : API exporter offering scalable production and consistent global supply.

- CENTRIENT PHARMACEUTICALS INDIA PVT LTD : Global producer of beta-lactam APIs with strong regulatory compliance.

- HIMEDIA LABORATORIES PVT LTD : Life sciences company supporting antibiotic manufacturing and quality control.

- AUROBINDO PHARMA LTD : Leading Amoxicillin supplier with a significant share of export shipments.

These organizations operate across multiple regulated and semi-regulated markets, positioning them as commercially proven, export-ready manufacturers with the scale, compliance strength, and operational expertise required for high-volume pharmaceutical sourcing. Their geographically concentrated production hubs enable cost efficiency, faster turnaround times, and consistent supply reliability, making them strategic partners for buyers seeking immediate procurement, long-term contracts, and market expansion.

Active Global Buyers Driving Amoxicillin Import Demand

On the demand side, global trade is supported by established pharmaceutical importers and distribution-focused buyers that consistently source Amoxicillin APIs to supply regulated and semi-regulated healthcare markets. These organizations play a critical role in maintaining

continuity across national drug supply chains:

- HERAI FARMA MEDICINE AND MEDICAL – Pharmaceutical importer and distributor serving hospital and retail healthcare networks.

- CONTINENTAL PHARMA SARL – International pharmaceutical trading company supplying APIs and finished products to regulated markets.

- HERAI FARMA MEDICINES AND MEDICAL SUPPLIES – Regional healthcare distributor focused on essential medicines and API sourcing.

- CENTRIENT PHARMACEUTICALS NETHERLANDS BV – European pharmaceutical entity supporting global API procurement and distribution.

Analyzing procurement behavior across these buyers reveals repeat sourcing patterns, regulatory-aligned purchasing, and market-specific demand drivers. For exporters and API manufacturers, these entities represent active, qualified buyers whose import activity reflects real commercial demand shaped by healthcare policies, population needs, and antibiotic treatment protocols across their respective regions.

Top Destination Countries for Amoxicillin Exports

| Country | Volume | Revenue | Price/kg |

|---|---|---|---|

| Algeria | 168,919 | 8.97M | 53.12 |

| Iraq | 146,966 | 3.03M | 20.64 |

| United Arab Emirates | 93,678 | 3.02M | 32.21 |

| Iran | 59,700 | 1.33M | 22.36 |

| Nigeria | 29,951 | 0.91M | 30.53 |

10-Year Export Volume and Value Trend Analysis

The decade-long data provides an excellent case study on how pharmaceutical trade evolves in response to global events and scientific developments.

-

In 2015, the combination reached around 2,000 MT, with revenues near $54,498.

-

After a significant drop in 2016, the market gradually gained momentum.

-

From 2019 onward, exports began climbing consistently, reflecting renewed global reliance on established antibiotic therapies.

-

2024 stands out as a landmark year, showing the highest recorded volume and revenue.

-

Projections for 2025 suggest a recalibration to 128,013 MT, demonstrating how markets stabilize after exceptional surges.

Pricing Dynamics and Market Volatility

Examining the pricing per kilogram over the 10-year period reveals a pronounced volatility. Prices per kg ranged from a low of about $13.67 in 2018 to a high near $53.12 per kg in 2024, coinciding with Algeria’s average export price. After soaring in 2019 and again in 2024, pricing declined sharply in 2025 to approximately $29.41 per kg. This variation suggests responsiveness to market demand, supply conditions, and potentially regulatory influences especially in key destination markets.

HS Code Classification & Regulatory Compliance

Amoxicillin API trade is classified under HS Code 29, which covers medicinal substances in international pharmaceutical trade. This classification enables standardised customs processing and regulatory tracking across global markets.

- Total Export Volume: ~596,867 kg

- Total Trade Value: ~$22.08 million

- Average Export Price: ~$36.99 per kg

High-Growth Import Markets & Sourcing Opportunities

Countries such as Algeria, the United Arab Emirates (UAE), and Iraq continue to demonstrate repeat import behavior and steadily rising shipment volumes. These markets present strong opportunities for new exporters, API suppliers, and pharmaceutical distributors seeking sustainable demand and long-term partnerships.

From a buyer’s perspective, these regions also highlight where supplier competition is most active, enabling effective benchmarking of pricing structures, quality standards, and delivery reliability. Strategic sourcing in these markets can unlock cost efficiencies, improved negotiation leverage, and faster market penetration.

Conclusion: The Future Trajectory of Amoxicillin Trade (2025–2030)

Based on the decade-long data, Amoxicillin, export, trade has demonstrated remarkable growth with peaks in volume and pricing especially in 2024. Despite observed volume corrections in 2025, the overall trajectory implies a strong market with cyclical pricing influenced by global demand patterns. Looking forward to 2025–2030, continued expansion in emerging markets—coupled with adherence to stringent trade compliance and regulatory standards—will be essential for sustaining growth. This data-driven outlook underscores a promising future for stakeholders in the Amoxicillin export trade arena.

With the ongoing developments, Amoxicillin remains a staple in antibiotic therapies, reinforcing its position in the global market.

For more detailed international trade statistics, visit the UN Comtrade database. Additional insights on pharmaceutical regulations and harmonisation standards can be reviewed at the International Council for Harmonisation (ICH).

Unlock Live Amoxicillin Import Intelligence

Monitor real-time Amoxicillin trade flows, verify certified suppliers, and benchmark pricing across 100+ global markets with precision-grade intelligence for pharmaceutical procurement teams.