Global Demand, Market Drivers & Pharmacological Role

Pharmacological & Industrial Importance

Mannitol is widely used in pharmaceuticals (as an excipient, osmotic diuretic in specialized formulations, and parenteral-grade excipient), in food and nutraceuticals as a low-calorie bulking agent, and across certain industrial applications. Its physicochemical properties (non-hygroscopic grades, parenteral purity) make it a versatile ingredient for regulated markets and high-value formulations.

Major Medical & Industrial Applications

- Pharmaceutical excipient: tablet diluent, tablet mouthfeel modifier, lyophilized formulation bulking agent

- Parenteral use: IV-grade mannitol for osmotic diuresis and specific hospital therapies

- Food & nutraceutical: low-calorie sweetener and bulk agent in sugar-free products

- Industrial uses: specialty chemical intermediates and laboratory reagents

Market Drivers

India’s strength in mannitol exports is supported by:

- Specialized manufacturing hubs with experience in sugar-alcohol production and pharmaceutical-grade processing

- Regulatory compliance for pharma-grade production serving regulated buyers

- Competitive pricing owing to efficient synthesis and large batch processing

- Backward integration in feedstock and refinement processes to limit raw-material swings

- Diverse buyer base across pharmaceuticals, food ingredients, and industrial sectors

- Quality focus enabling access to premium markets that demand parenteral-grade material

Demand Patterns (2025 till October)

Regional demand in 2025 (through October) shows strong uptake from South Asia, North America, Africa, and selected emerging markets. Regulated markets (e.g., the United States) tend to source higher-value, pharma-grade mannitol at premium prices, while neighbouring markets procure larger volumes for formulation and food applications.

| Country | Revenue (USD) | Volume (KG) | Avg. Price per KG (USD) |

|---|---|---|---|

| Bangladesh | 6,942,842.77 | 868,227.89 | 7.99 |

| United States | 3,874,182.17 | 538,587.25 | 7.19 |

| Iraq | 2,879,770.61 | 9,776.20 | 294.57 |

| Nepal | 2,061,360.21 | 312,026.00 | 6.61 |

| South Africa | 1,636,795.94 | 205,203.00 | 7.98 |

The very high average price for some Iraq shipments likely reflects small-volume, high-value consignments (specialty or high-purity grades) rather than bulk commodity shipments. Meanwhile, Bangladesh and neighbouring South Asian markets continue to represent the largest-volume destinations.

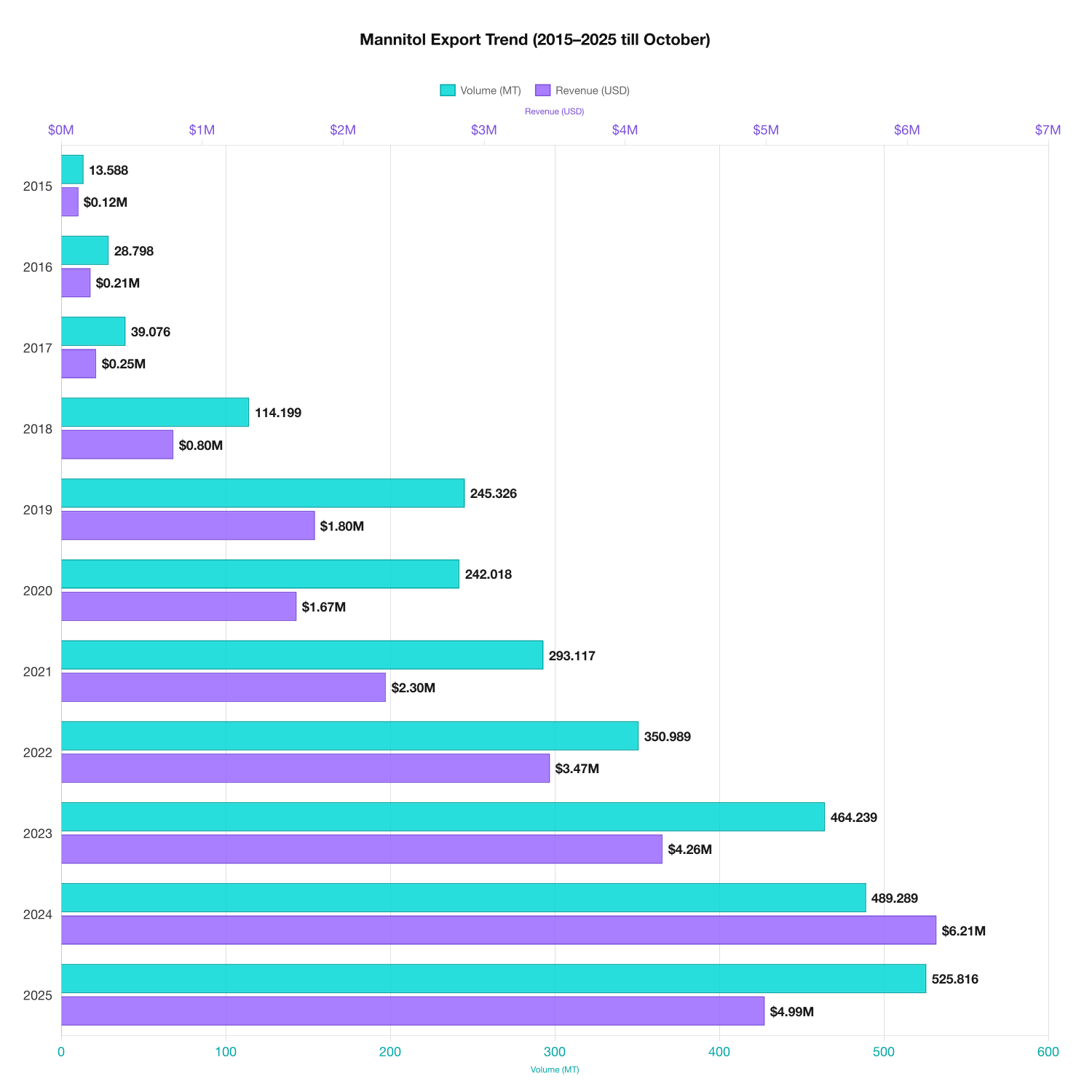

Historical Export Trends (2015–2025)

The following analysis summarizes India’s Mannitol export performance from 2015 through 2025 (data through October 2025). These years capture the product’s steady market growth, occasional price spikes, and expanding global uptake.

Trend Interpretation

Mannitol exports from India show a clear growth trajectory in both value and volume between 2015 and 2025. Early years (2015–2018) record modest trade values and volumes; from 2019 onward volumes rose sharply and export value accelerated — reflecting greater adoption in pharmaceutical formulations and rising industrial demand.

Notable observations from the 2015–2025 series:

- Revenue rose from roughly USD 122.6k in 2015 to multi-million USD levels by 2024, with 2024 revenue peaking above USD 6.2M.

- Volume increased steadily, reaching over 525,800 kg in 2025 (data through October 2025).

- Average export price per kg showed volatility — a low–mid single digits in early years, rising to a peak average of about USD 12.68/kg in 2024 before moderating to roughly USD 9.49/kg in 2025.

These patterns indicate expanding global demand and periodic price re-rating driven by short-term supply tightness or quality-premium shipments. Overall, India strengthened its position as a dependable supplier through scale, competitive manufacturing, and an expanding roster of exporting firms.

Competitive Landscape, HS-Code Insights & Industrial Strength

Leading Indian Manufacturers & Exporters

India’s mannitol export ecosystem comprises numerous specialized chemical and excipient producers. Key exporting companies (by shipment activity and market presence) include:

- SIGNET EXCIPIENTS PVT LTD – Major excipient supplier with wide export reach.

- HIMEDIA LABORATORIES PVT LTD – Pharma-focused manufacturer and exporter.

- SIGNET CHEMICAL CORPORATION PVT LTD – Integrated chemical supplier for pharma and food industries.

- SISCO RESEARCH LABORATORIES PVT LTD – Known for specialty chemicals and analytical-grade products.

- MANNITAB PHARMA SPECIALITIES PVT LTD – Dedicated mannitol specialist with focused capacity.

- JAYANA PHARMA – For regulated-market supplies and formulation inputs.

- LOBA CHEMIE PVT LTD – Broad chemical distribution network and export footprint.

- SUDARSHAN TRADING CO – Active trading/export house for excipients.

- NISHCHEM INTERNATIONAL PVT LTD – Exporter with regional reach.

- ORIENT PHARMA – Consistent supplier in pharmaceutical channels.

Major International Buyers

- CITIBANK (as a consignee/financial intermediary in some shipments)

- ALIDAC HEALTHCARE MYANMAR LTD

- HIMEDIA LABORATORIES LLC (overseas affiliate buyers)

- TERUMO BCT VIETNAM CO LTD

- OMAN PHARMACEUTICAL PRODUCTS CO LLC

HS-Code Insights

Mannitol-related exports display broad participation across exporters and product grades. Key HS-code metrics (aggregated across mannitol-relevant classifications) show:

- Unique exporters: 394 active companies

- Unique importers: 916 identified buyers

- Total HS-code export value: USD 27,494,686.48

- Total HS-code volume: 3,059,275.25 KG

- Average HS-code price per KG: USD 8.99/kg

- Top HS-code exporters (active): 345

These numbers confirm India’s diversified exporter base and sizeable global shipments in 2025 (data through October).

Authoritative HS-code reference:World Customs Organization – HS Nomenclature Overview

Investment Outlook & Future Opportunities

India’s Mannitol industry is well-positioned for continued expansion as pharmaceutical formulation demand and specialty food/nutraceutical use-cases grow. Strategic investments and capability upgrades can capture both volume-led and premium, regulated-market opportunities.

Strategic Investment Areas

- Capacity expansion to service large-volume buyers in South Asia and Africa

- Upgrading to parenteral-grade facilities to access premium hospital and regulated markets

- Backward integration into feedstock and refining to protect margins and control quality

- Green-chemistry and waste-minimization for sustainable excipient production

- Digital traceability and serialization for regulated supply chains

Future Outlook

Given steady volume growth, recent price oscillations, and a broad exporter base, Mannitol exports from India are expected to remain robust. Demand from pharmaceuticals (especially for excipient and parenteral applications) and from regional food industries will be primary drivers. Investments in quality upgrades, sustainable manufacturing, and targeted regulatory approvals will unlock higher-value opportunities in developed markets.

Conclusion

With 394 active exporters, a large and diverse import base, and total HS-code exports valued at roughly USD 27.5M (3.06 million kg), India continues to be a critical supplier of Mannitol globally. Scale, quality focus, and strategic upgrades will determine how exporters capture the next phase of growth in both regulated and emerging markets.

Strengthen Your Pharma & Excipient Trade Decisions Today

Enhance your understanding of India’s Mannitol export ecosystem with concise, data-backed insights on global demand, pricing behaviour, and market opportunities. Use verified trade intelligence to identify high-growth markets and optimize sourcing or market-entry strategies.