India’s position in the global Ibuprofen API supply chain continues to strengthen as manufacturers scale production, enhance compliance, and expand their presence across both regulated and semi-regulated markets. As one of the most widely used profen molecules worldwide,it plays a central role in pain management, anti-inflammatory therapy, and fever reduction. Its relevance has grown steadily across global healthcare systems, creating strong and sustainable global demand for both bulk drug API and finished formulations.

Over the last decade, India has demonstrated remarkable consistency and resilience in exports, maintaining advantages in cost, production capacity, and regulatory approval. The country’s leadership in this active pharmaceutical ingredient manufacturing also reflects its broader pharmaceutical capabilities — from chemical synthesis and impurity control to backward-integrated production ecosystems that meet international quality benchmarks.

India’s Position in the Global Ibuprofen API Ecosystem

India remains one of the most diversified and resource-rich producers of this API, backed by advanced drug manufacturing clusters across Gujarat, Punjab, and Tamil Nadu. With 387 unique exporters and over 2,091 active importers globally, India maintains a strong commercial footprint in both raw material supply and finished drug distribution.

The ability to balance exports with domestic consumption allows India to maintain market stability even during periods of fluctuating global demand, such as post-pandemic pharmaceutical realignments. Many buyers prefer Indian API due to:

- Consistent GMP-certified API quality

- Competitive large-scale production capabilities

- Reliability of supply from integrated manufacturing ecosystems

- Strong compliance across USFDA, EDQM, and WHO-GMP frameworks

These strengths have helped create a stable global footprint for Indian API, even as pricing cycles and consumption patterns shift year to year.

Top Companies Leading India’s Exports

India’s API manufacturing and export landscape is driven by a group of well-established and highly compliant companies. Based on export data, the top performers include:

- SOLARA ACTIVE PHARMA SCIENCES LTD

- IOL CHEMICALS AND PHARMACEUTICALS LTD

- STRIDES SHASUN LTD

- SHASUN PHARMACEUTICALS LTD

- SHUBHAM PHARMACHEM PVT LTD

- ATTAR GLOBAL

- MAHIMA LIFE SCIENCES PVT LTD

- LUNA CHEMICAL INDUSTRIES PVT LTD

- GLOBELA PHARMA PVT LTD

- ESPEE PHARMA CHEM PVT LTD

These exporters have helped India become one of the world’s prime suppliers of this API, consistently meeting the needs of nations across Europe, Asia, Latin America, and the Middle East.

Top Importing Companies Strengthening India’s Outbound Trade

On the buyer side, the demand for Indian active pharmaceutical ingredient remains broad and international. The leading importers of Indian include:

- RECKITT HEALTHCARE INTERNATIONAL

- STRIDES SHASUN LTD

- AMNEAL PHARMACEUTICALS

- VIVATIS PHARMA GMBH

- PHARMACHEMICALS HANDELS GMBH

- INDUKERN SA

- PATHEON

- FAMAR

- CATALENT ARGENTINA SAIC

These companies represent a cross-section of global drug formulators, contract manufacturers, and healthcare distributors, reflecting the diverse global demand profile for imports.

10-Year API Export Trends (2015–2025)

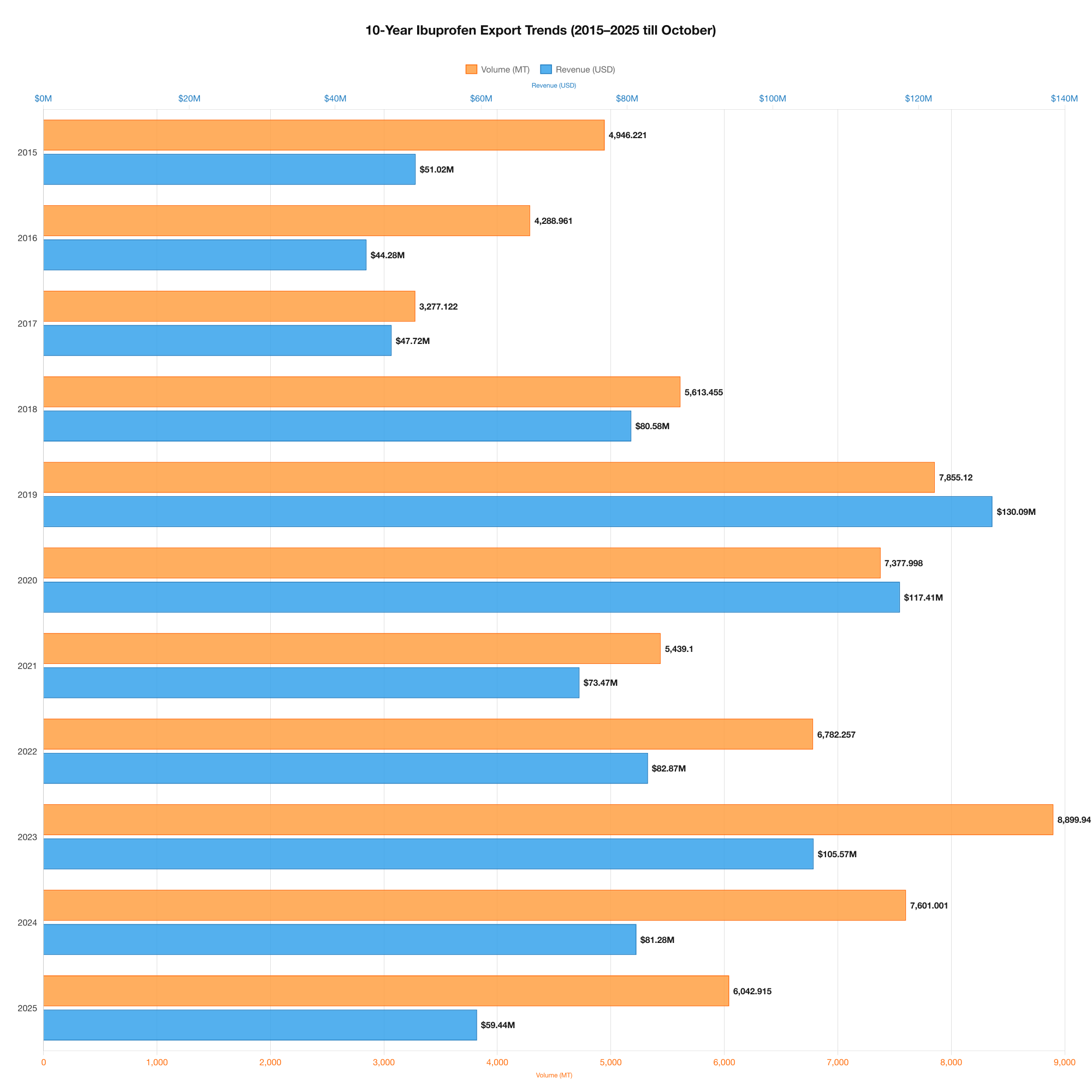

India’s decade-long API performance highlights changing consumption patterns, pricing cycles, and expanded global requirements across the pharmaceutical sector. According to the 10-year dataset:

1. Revenue Growth & Decline Cycles

- 2015–2017: Exports averaged USD 45–50 million annually.

- 2018–2020: A major surge occurred, peaking at USD 130 million in 2019, driven by high international consumption and supply chain shifts.

- 2021–2025: Post-pandemic stabilization brought values between USD 59–105 million.

2. Volume Trends

Export volumes increased significantly from 3.2 million KG in 2017 to over 8.8 million KG in 2023, illustrating expanding manufacturing capacity and international reliance.

3. Pricing Trends

This active pharmaceutical ingredient prices varied from USD 9.83 to USD 16.56 per KG across the decade.

The highest per-KG price was recorded in 2019, reflecting global shortages and cost surges in chemical intermediates.

4. Consistent Double-Digit Pricing

Despite fluctuations, pricing remained within sustainable margins for exporters, allowing India to retain competitiveness.

Top Destination Countries of Exports

India’s API exports reach more than 80 countries, with the top destinations (2025) being:

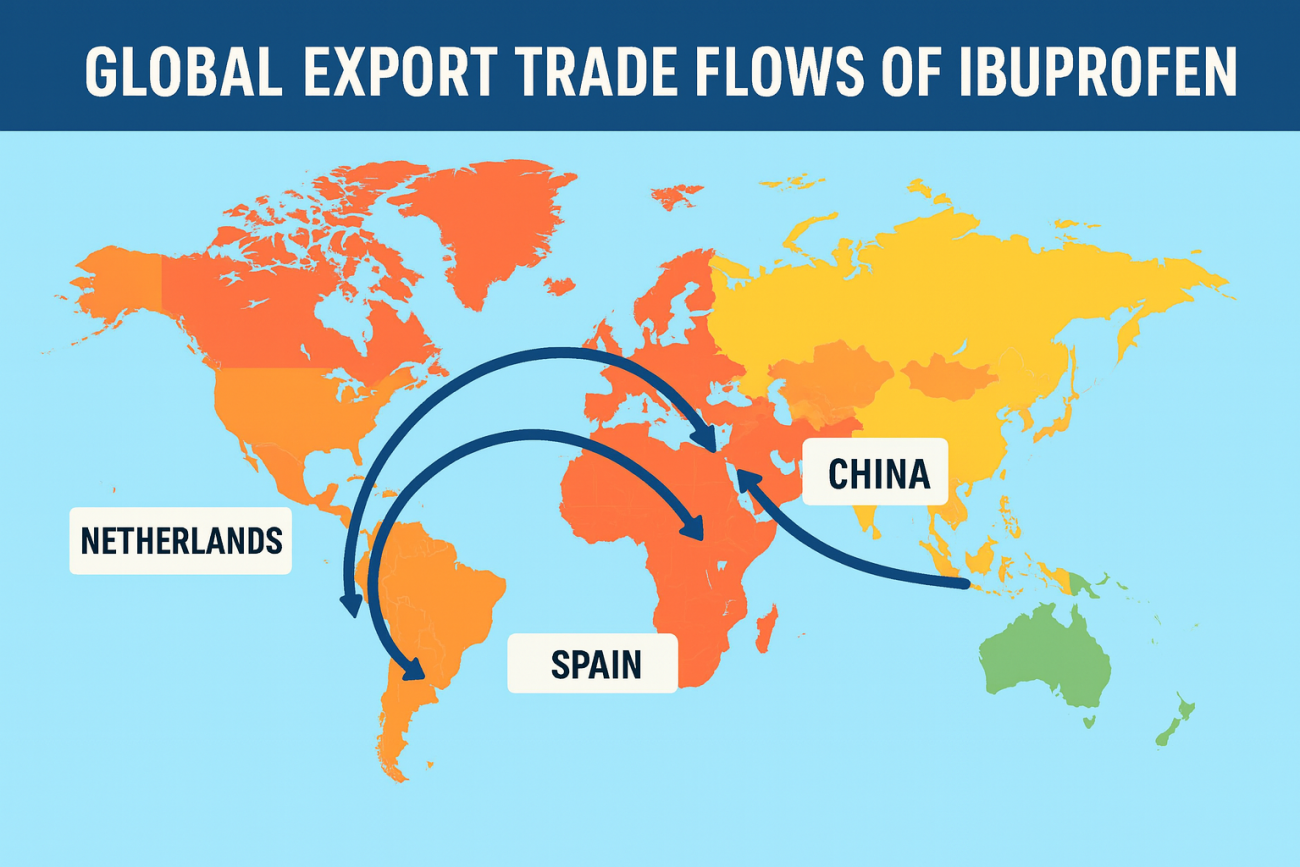

Countries like the Netherlands, Spain, and the UK remain major formulation centers, driving stable API exports year after year.

Key Factors Behind India’s Export Competitiveness

1. Strong Regulatory Compliance

Indian profen manufacturers operate under WHO-GMP, EDQM, and USFDA-approved frameworks, ensuring international acceptance.

2. Cost-Effective Large-Scale Production

Economies of scale reduce per-unit cost, making Indian API price-competitive.

3. Green & Sustainable Manufacturing

Many facilities utilize solvent recovery, green chemistry principles, and cleaner process technologies.

4. Backward Integration

Integrated supply chains reduce dependency on intermediate imports and improve consistency.

5. Stable Global Demand

This active pharmaceutical ingredient consumption remains high globally due to ongoing therapeutic needs in pain and inflammation management.

Future Outlook: Strengthening India’s Global API Leadership

India’s API market is expected to maintain a 5–7% CAGR through 2026, supported by:

- Government incentives under Make in India and the PLI Scheme

- Capacity expansion by major profen manufacturers

- Increased adoption of green manufacturing technologies

- Strong international recognition of Indian API quality

Given rising healthcare needs and formulation expansion, India will continue to play a dominant role in exports, catering to global pharmaceutical makers seeking high-purity, cost-effective, and compliant profen APIs.

Conclusion

India’s role in the global API ecosystem continues to strengthen, supported by its manufacturing scale, cost efficiencies, and internationally recognized regulatory standards. Global health agencies such as the World Health Organization (WHO) and regulatory bodies like the U.S. FDA and the European Medicines Agency (EMA) emphasize quality frameworks that align well with India’s growing compliance capabilities.

With a strong exporter base, expanding global buyer network, and consistent demand for analgesic and anti-inflammatory therapies, India has developed a resilient and competitive supply chain for Ibuprofen API. Backward integration, improved production technologies, and cost-effective operations further strengthen the country’s long-term global position. As worldwide healthcare needs expand, India’s ability to deliver high-purity, quality-assured, and economically viable API will ensure its continued leadership in international pharmaceutical trade.

Make Smarter API Trade Decisions Today

Access verified data, pricing trends, exporter insights, and global demand analytics to strengthen your API procurement strategy.