The pharmaceutical and industrial chemicals ecosystem in 2024 relies heavily on a dynamic mix of chemical intermediates that drive mass-scale synthesis, formulation efficiency, purification workflows,and analytical precision. As global manufacturing shifts toward higher compliance, cost optimization, and technical capability, these intermediates remain central to the world’s chemical and pharmaceutical value chains.This updated review explores the export–import footprint, supplier depth, market behavior, and strategic relevance of the top intermediates shaping global trade in 2024 — with India playing a decisive role as a growing production hub.

For a broader view of API market movements, also read our related analysis on Top Active Pharmaceutical Ingredients (APIs).

Market Overview: The Intermediates Driving Modern Pharma & Chemical Manufacturing

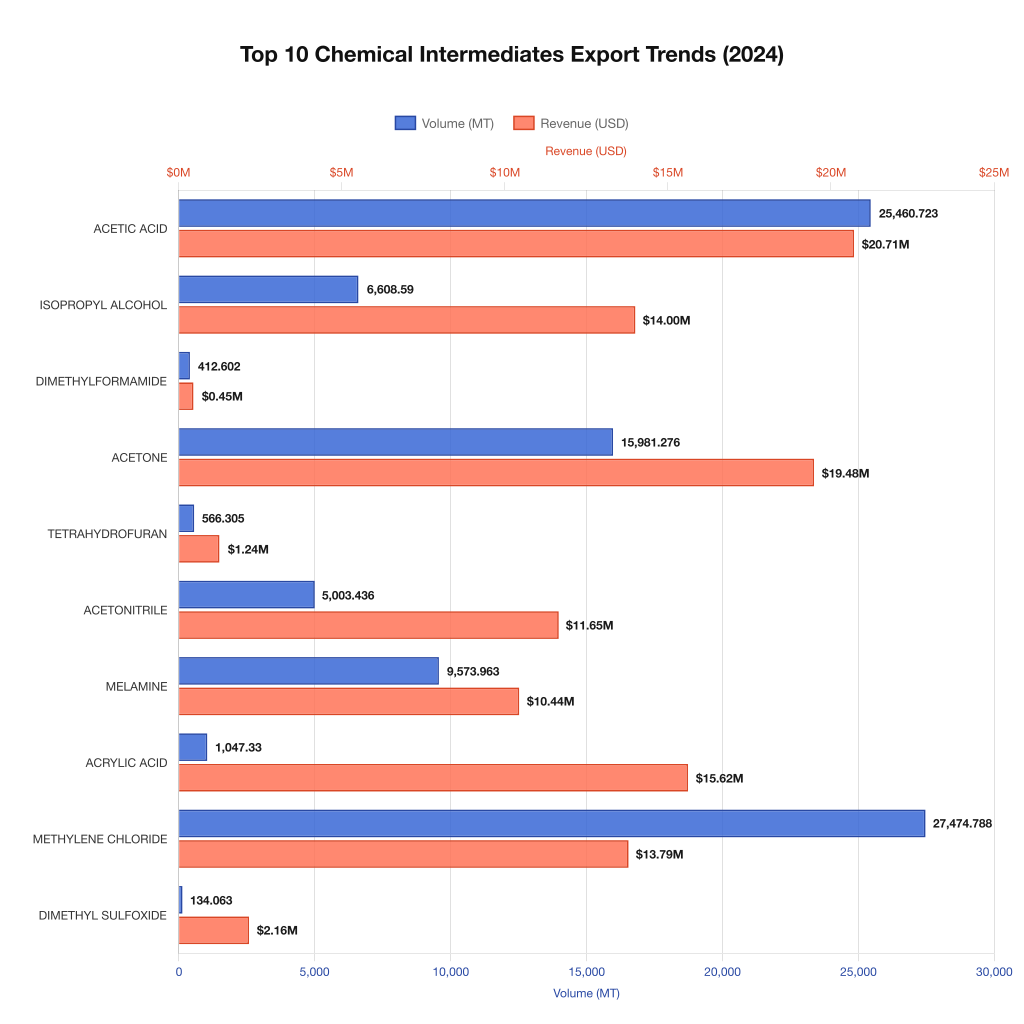

Global demand continues to rely on a balanced portfolio of materials — as reflected in global shipment patterns reported by the UN Comtrade chemical trade database — from high-volume commodity solvents such as Acetic Acid, Acetone, IPA, Methylene Chloride and THF, to premium-grade intermediates like Acrylic Acid, Acetonitrile, DMSO, and DMF. These chemicals form the backbone of reaction chemistry, extraction processes, laboratory analytics, and polymer science.

India’s expanding manufacturing capabilities, strong chemical clusters, and cost advantages further solidify its position as a major global supplier. With stronger regulatory alignment and improved documentation standards, Indian exporters now influence a significant share of global flows for many key intermediates.

Top 10 Chemical Intermediates — Detailed Profile Analysis

Below is an in-depth profile of the most actively traded intermediates of 2024. Each section integrates its global role, applications, and verified 2024 trade data.

1. Acetic Acid — The Core Backbone of Global Synthesis Chemistry

Acetic Acid demonstrates one of the strongest global footprints with 756 exporters and 1,656 importers recorded.Shipment data shows a total trade value of $20.70 million across 25.46 million kg, averaging $0.81 per kg.

Key Applications:

- Manufacture of APIs like aspirin, paracetamol, acetaminophen

- Solvent for extraction and purification

- Production of vinyl acetate monomer (VAM)

- Plastics, textiles, paints, and chemical synthesis

Market Characteristics (2024):

- Stable global demand with extensive production capacity

- Highly competitive pricing due to supplier diversity

- Broad availability across regulated & semi-regulated markets

2. Acetone — A Universal Process Solvent With Strong Global Momentum

Acetone maintains a strong trade presence with 590 exporters and 1,290 importers. In 2024, it recorded a trade value of $19.48 million across 15.98 million kg, averaging $1.21 per kg.

Applications:

- Pharma-grade cleaning and equipment decontamination

- Reaction medium for synthesis workflows

- Manufacture of MMA, bisphenol-A, resins, coatings

- Personal care & cosmetic formulations

Market Behavior (2024):

- Pricing aligned with phenol–acetone production balance

- Large-volume consumption across diverse industries

- Stable global supply from major chemical clusters

3. Acrylic Acid — A Strategic High-Value Intermediate for Polymer & Adhesive Industries

Acrylic Acid shows high value concentration with 146 exporters and 231 importers. 2024 data reports $15.61 million traded across 1.04 million kg, delivering an elevated average price of $14.91 per kg.

Applications:

- Superabsorbent polymers (SAP)

- Adhesives, coatings, pressure-sensitive materials

- Production of acrylate esters

- Specialty pharmaceutical formulations

Market Trends (2024):

- Premium pricing due to complex production routes

- High-purity requirements for polymer-grade materials

- Limited global capacity concentrated in Asia

4. Methylene Chloride (DCM) — A High-Efficiency Solvent for Extraction & Cleaning

Methylene Chloride retains broad global adoption with 440 exporters and 1,030 importers. 2024 shipments totaled $13.79 million across 27.47 million kg, averaging $0.50 per kg, reflecting its commodity nature.

Applications:

- Extraction of caffeine, APIs, and natural products

- Paint stripping and metal cleaning

- Polymer & adhesive processing

- Reaction medium for pharmaceuticals

Market Dynamics (2024):

- Increasing environmental restrictions

- Continued high usage in pharma & industrial cleaning

- Robust global availability

5. Acetonitrile — A High-Purity Solvent Essential for Analytical Chemistry

Acetonitrile remains indispensable for analysis-heavy industries, with 315 exporters and 797 importers. In 2024, total shipments reached $11.65 million across 5 million kg, averaging $2.32 per kg.

Applications:

- HPLC mobile phases

- High-purity extractions

- Vitamin B1 and specialty chemical manufacturing

- API and fine-chemical synthesis

Market Trends (2024):

- Price influenced by acetone cyanohydrin availability

- Growing analytical and QC demand worldwide

- Capacity expansions in India & China

6. Melamine — A Key Intermediate for Resins, Laminates & Durable Coatings

Melamine shows consistent global demand with 143 exporters and 254 importers.2024 data reveals $10.43 million traded over 9.57 million kg, averaging $1.09 per kg.

Applications:

- Melamine–formaldehyde resins

- Laminates, sealants & durable coatings

- Thermoset plastics

- Flame-retardant materials

Market Characteristics:

- Predictable pricing and consumption patterns

- High demand from construction & furniture sectors

- Limited pharmaceutical relevance but strong industrial demand

7. Isopropyl Alcohol (IPA) — The World’s Most Widely Used General-Purpose Solvent

IPA maintains the largest trade footprint with 782 exporters and 1,622 importers.2024 shipments recorded $13.99 million across 6.6 million kg with an average price of $2.11 per kg.

Applications:

- Disinfectants & sanitizers

- Pharmaceutical extraction & purification

- Electronics cleaning

- Paints, coatings, adhesives

Trade Behavior (2024):

- Highly liquid global market

- Stable but high industrial demand

- Competitive pricing across multiple regions

8. Dimethyl Sulfoxide (DMSO) — A High-Purity Solvent for Sensitive Applications

DMSO is a specialized solvent supported by 221 exporters and 483 importers.In 2024, total trade amounted to $2.15 million across 134,062 kg, with a premium price of $16.08 per kg.

Applications:

- Drug formulation & solubility enhancement

- Cryopreservation media

- Fine-chemical & organometallic synthesis

- Precision analytical processes

Market Insights (2024):

- Higher price point due to purity requirements

- Growing demand from biotech & pharma

- Ultra-pure grades command premium pricing

9. Tetrahydrofuran (THF) — A Critical Solvent for Polymerization & Elastomer Production

THF demonstrates stable market activity with 203 exporters and 419 importers.In 2024, it accounted for $1.24 million in trade across 566,305 kg, averaging $2.19 per kg.

Applications:

- PTMEG & elastomer production

- PVC & polymer formulations

- Grignard & organometallic reactions

- Research-grade polymer science

Market Notes (2024):

- Sensitive to butanediol feedstock trends

- Growing demand in synthetic fiber sectors

- High usage in advanced polymer chemistry

10. Dimethylformamide (DMF) — A Polar Solvent Under Regulatory Scrutiny

DMF continues to anchor polymer and API synthesis workflows, supported by 252 exporters and 489 importers. In 2024, it showed $447,672 in trade across 412,602 kg, averaging $1.08 per kg.

Applications:

- Peptide & polymer synthesis

- Acrylic fiber production

- API crystallization

- Fine chemical synthesis

Market Evolution (2024):

- Stricter regulatory requirements in EU & US

- Stable pharma & polymer demand

- High solvency with limited alternatives

Global Trade Trends & Market Behavior in 2024

2024 shipment data highlights a sharp divide between high-volume commodity solvents and high-margin specialty intermediates, with each category showing distinct sourcing dynamics.

Commodity solvents like Acetic Acid, IPA, and Methylene Chloride dominate trade volumes due to mass-scale industrial and pharmaceutical usage. Specialty materials such as Acrylic Acid, DMSO, and Acetonitrile command significantly higher prices per kg due to purity, complexity, and limited global capacity.

Procurement Strategy for 2024: How Buyers Should Navigate the Market

1. Large Supplier Bases Reduce Procurement Risk

- Increase redundancy with multi-supplier contracts

- Utilize competitive pricing to optimize sourcing

- Lower risk from regional disruptions

2. Specialty Intermediates = Higher Margin Potential

- Acrylic Acid — strong profitability due to premium pricing

- DMSO — biotech-driven demand surge

- Acetonitrile — essential for analytical QC and high-purity processes

3. Quality & Compliance Are Non-Negotiable

- COAs, SDS, and GMP-aligned documentation are mandatory

- Pharma-grade purity directly affects pricing

- Regulated markets demand complete traceability

4. Inventory Planning Must Match Category Behavior

- JIT ideal for stable commodities like IPA

- Buffer stocks advised for volatile chemicals like Acetonitrile

Conclusion: Strategic Role of Chemical Intermediates in 2024

As global supply chains become more data-driven and cost-optimized, chemical intermediates continue to power pharmaceutical, polymer, and specialty chemical manufacturing across the world. The 2024 landscape clearly highlights the balanced reliance on both mass-volume solvents and precision-grade specialty chemicals.

For businesses engaged in chemical exports from India, competitive strength will come from:

- efficient scale and cost leadership,

- regulatory-ready documentation,

- and the ability to deliver consistent high-purity intermediates.

With rising global compliance and increasing manufacturing diversification, these intermediates remain pivotal across pharmaceuticals, industrial chemistry, materials science, and research.

Optimize Your Chemical Intermediate Procurement with Proven Market Intelligence

Equip your team with precise demand trends, exporter depth, price movements, and compliance insights.

This guide helps you assess supplier reliability, purity standards, and risk exposure—building stronger negotiations and resilient procurement pipelines.