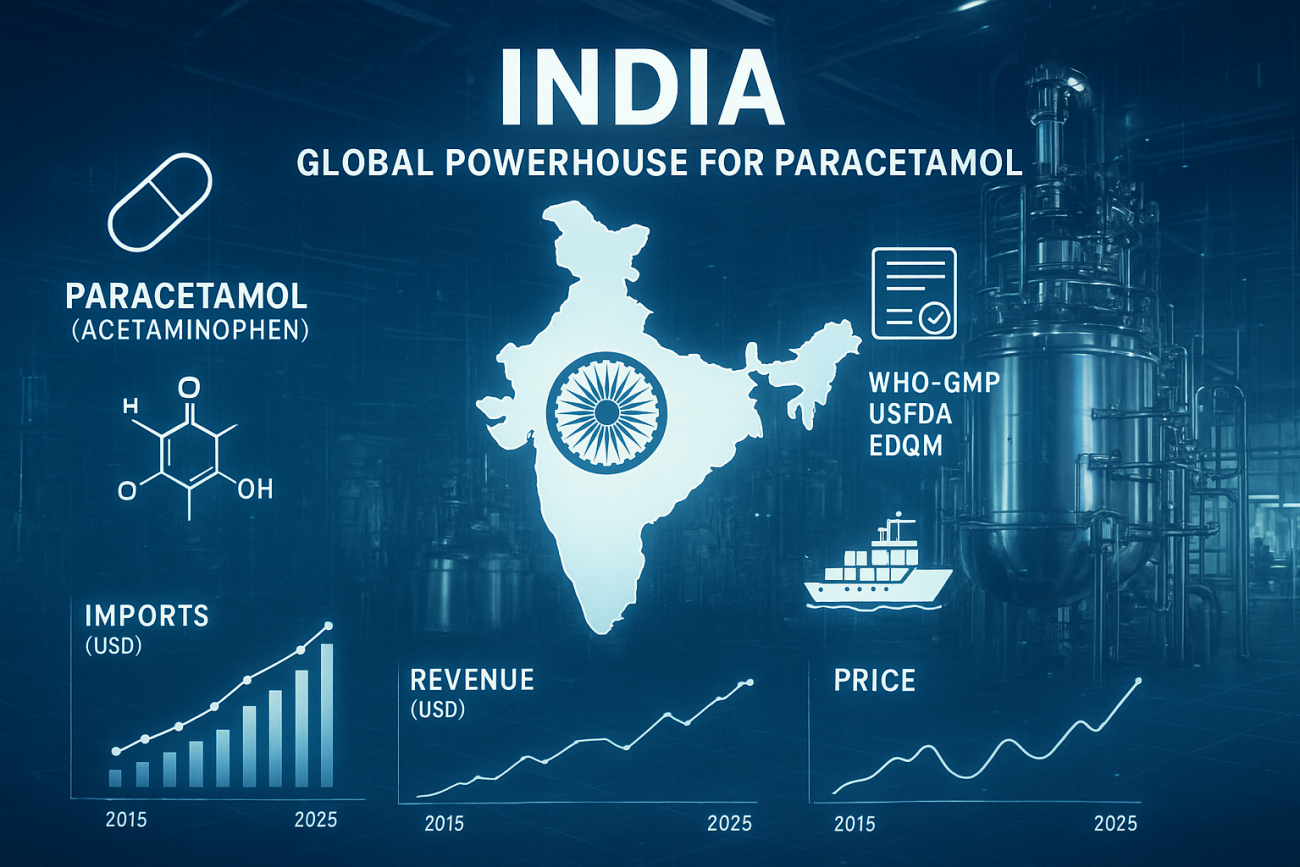

Market Overview — Why India Imports Paracetamol

Key counts (data through Oct 2025): 214 unique exporters supplied acetaminophen to India and 249 unique Indian importers were active in import records.

Imports form part of a wider sourcing strategy — balancing domestic production, imported specialty grades, and cost optimization for finished-dosage exports. This helps Indian formulators maintain uninterrupted supply for hospitals, retail OTC markets, and export consignments.

Import Trends (2020–2025 up to Oct 2025)

The table below shows annual import value, volume (kg), and average price per kg. Values are consolidated from verified shipment records through October 2025.

Trend summary

Price volatility peaked in 2021–2022 — a period marked by global raw-material shortages and supply-chain pressure that elevated per-kg prices. Imports dropped in 2023 as domestic production recovered, before rebounding in 2025 (through October) as formulators diversified procurement to manage cost and ensure grade availability. Overall, import volumes in 2025 indicate renewed demand for certain grades and stabilisation of pricing around the low-to-mid USD 4s per kg for many bulk categories.

Top Exporting Companies (Suppliers) & Leading Indian Importers

Top global suppliers to India (recorded exporters)

| Exporting Company |

|---|

| ANQIU LUAN PHARMACEUTICAL CO LTD |

| MALLINCKRODT CHEMICAL LTD |

| SIGMA ALDRICH CO LLC |

| NOVACYL ASIA PACIFIC LTD |

| ANQIU LUAN PHARMACEUTICAL CO |

| FLAVINE NORTH AMERICA INC |

| HEBEI JIHENG PHARMACEUTICAL CO LTD |

| HEBEI JIHENG GROUP PHARMACEUTICALS CO LTD |

| HEBEI JIHENG GROUP PHARMACEUTICALS |

Leading Indian importers (top buyers & formulators)

| Importing Company |

|---|

| SIGMA ALDRICH CHEMICALS PVT LTD |

| CHROMACHEMIE LABORATORY PVT LTD |

| LGC PROMOCHEM INDIA PVT LTD |

| SANOFI INDIA LTD |

| SRI KRISHNA PHARMACEUTICALS LTD |

| GRANULES INDIA LTD |

| ADCOCK INGRAM LTD |

| MEDOPHARM |

| SHALINA LABORATORIES PVT LTD |

| MARKSANS PHARMA LTD |

These importers procure API for finished-dosage manufacturing, research & analytical use, and export-oriented contract manufacturing.

Destination / Source Country Notes & High-Interest Regions

The primary recorded destination in the import dataset shows substantial entries labelled under India (re-entries or specific customs recording). For broader strategic planning, procurement teams should monitor supplier countries such as China, the United States, and select European chemical hubs for specialized grades.

| Country (reported) | Import Value (USD) | Volume (KG) | Avg. Price / KG (USD) |

|---|---|---|---|

| INDIA (reported) | 7,528,257 | 1,443,493 | 5.21 |

Top regions / markets searching or showing rising interest

Trade and search-signal monitoring indicate increased regional interest from: Cuba, Mexico, Chile, Peru, and the Philippines. These markets show growing demand for imported finished formulations and occasionally for API sourcing partnerships, which creates downstream demand that indirectly affects India’s procurement behaviour.

Pharmacological Use & Industrial Applications

Paracetamol is a globally established analgesic and antipyretic. Indian formulators use imported API in a range of product types:

- Immediate-release tablets and caplets for OTC retail.

- Pediatric syrups and suspensions (specialized grades/density requirements).

- Combination products (with caffeine, antihistamines, or NSAIDs).

- Injectable formulations for hospital use (requires high-purity/sterile-grade API).

- Analytical & R&D supplies for stability and compatibility testing.

Because clinical safety margins are tight for injectable products, importers often prefer tested, vendor-qualified global suppliers that meet stringent pharmacopeial standards.

Industry Insights — Price Drivers, Correlations & Procurement Signals

Key drivers shaping import volumes and pricing:

- Feedstock price cycles: the cost of intermediates such as p-aminophenol (PAP) tracks petrochemical-linked feedstock pricing.

- Regulatory gating: purchases for regulated markets (EU, Japan) favour certified batches, which command premium pricing.

- Inventory strategies: manufacturers use imports to manage lead-time risk and avoid production stoppages.

- Contractual sourcing: CMOs and multinationals often require global vendor continuity, prompting imports even when local production is available.

- Seasonal demand: cold/flu seasons influence short-term upticks in bulk purchases for OTC lines.

Search behaviour & keywords: buyers and researchers commonly use the terms “acetaminophen” and “acetaminophen” when validating supplier qualifications, pricing, and pharmacopeial compliance. Optimizing procurement portals and product pages for both keywords improves discovery and vendor verification.

Future Trade Outlook & Strategic Recommendations (2026–2028)

Outlook

From 2026 to 2028, India’s acetaminophen import patterns will likely be shaped by three converging forces:

- Domestic capacity build-out: national API parks and the PLI program will increase self-sufficiency for many standard grades.

- Specialized import demand: injectable, micronized, and analytical grades will continue to be imported where domestic supply is limited.

- Regional demand growth: increased exports of finished dosages to emerging markets (including Cuba, Mexico, Chile, Peru, Philippines) will drive selective import requirements tied to formulation specs.

Strategic recommendations for importers & policymakers

- Diversify vendor panels: maintain multiple qualified suppliers across regions to mitigate single-source risk.

- Invest in joint quality programs: co-validation with exporters to reduce batch rejection and improve lead times.

- Monitor feedstock markets: hedging strategies on intermediates can stabilize API costs.

- Prioritise traceability: adopt batch-level digital traceability to meet global serialization and regulatory demands.

- Leverage regional opportunities: target growing markets (Cuba, Mexico, Chile, Peru, Philippines) for finished-dosage exports, which will influence upstream API procurement plans.

For additional global pharmaceutical trade references, you may review the

WHO essential medicines publications, which offer broader context on API demand and regulatory standards.

Conclusion — Imports as a Strategic Supply Lever

India’s acetaminophen import activity through October 2025 demonstrates that even large-producing countries rely on strategic imports to meet specialised grade requirements, manage risk, and support high-quality formulation exports. While domestic manufacturing expansion will reduce dependency on routine bulk grades, imports for premium, injectable, micronized, and research-grade acetaminophen will remain a necessary and value-adding part of India’s pharmaceutical supply chain.

Data note: all figures and company lists in this article are sourced from consolidated trade intelligence and shipment-level records with coverage up to October 2025.

For extended analysis on related import patterns, you can also review the

India’s Metformin HCL Import Insights 2025published on APIFDF.

Advance Your Pharma Sourcing Strategy with Clear Import Insights

Gain a sharper understanding of India’s Paracetamol import ecosystem with concise, data-driven insights on specialty grades, pricing patterns, supplier dynamics, and procurement trends. Stay informed with credible trade intelligence to evaluate exporter capabilities, manage sourcing risks, and identify regions showing rising demand—helping you make confident, strategy-aligned decisions in India’s evolving pharmaceutical supply chain.