Global Market Overview – India’s Expanding Paracetamol Export Footprint

India’s export performance in the Paracetamol API category underscores the country’s rising dominance in global pharmaceutical trade. With 531 verified exporters and over 1,600 importers recorded as of October 2025, India contributes significantly to international drug manufacturing and formulation supply chains. The growing preference for Indian Paracetamol stems from consistent quality, competitive pricing, and strong compliance with WHO-GMP and USFDA standards.

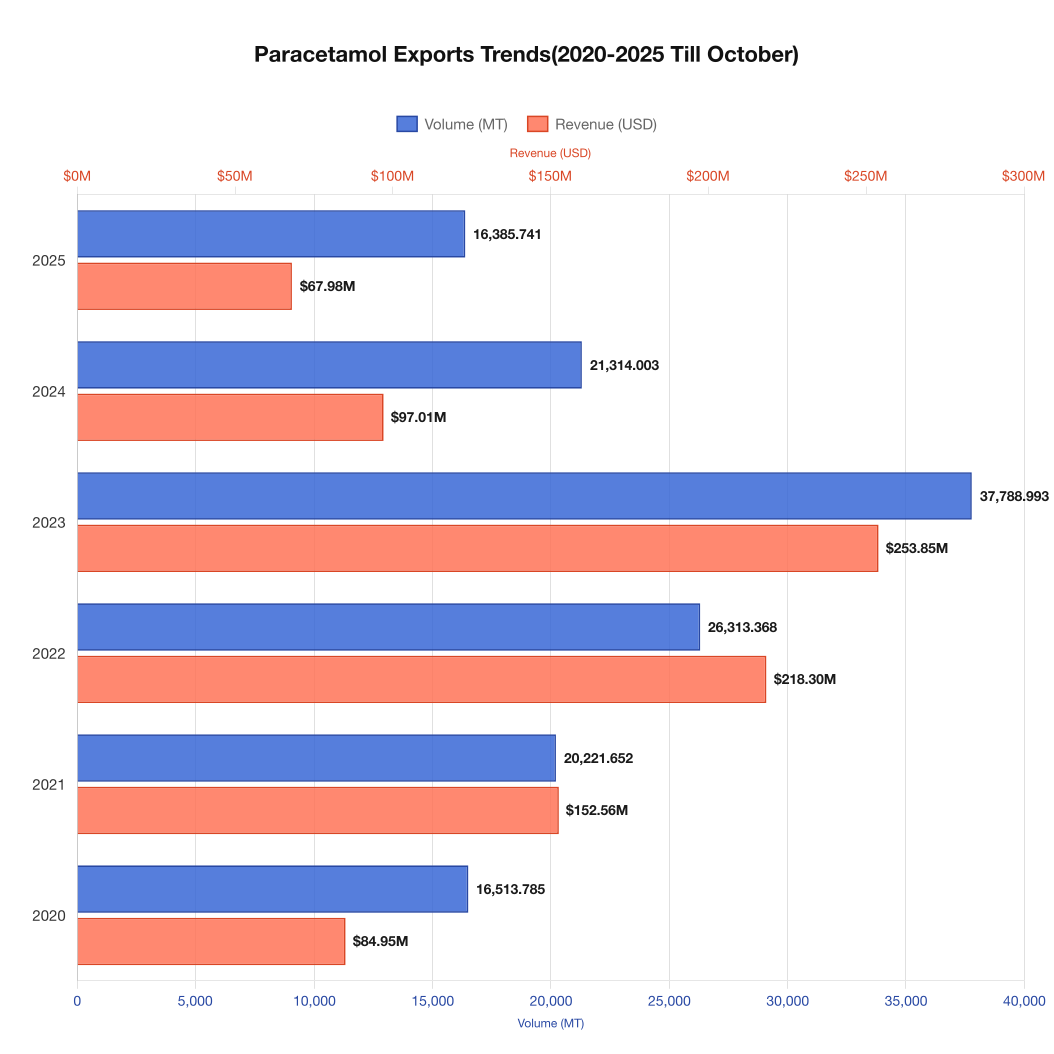

As per export records, India’s Paracetamol API shipments have steadily increased in both value and volume, particularly during the 2020–2023 period, driven by pandemic-related healthcare demand. Although the market saw temporary corrections in 2024–2025 due to normalization, the export base remains strong — highlighting sustained global dependency on Indian suppliers.

Export data clearly reflects India’s adaptability in the face of fluctuating demand cycles. Despite global pricing adjustments and raw material challenges, Indian Paracetamol exporters continue to supply large volumes, supported by advanced manufacturing hubs in Gujarat, Telangana, and Maharashtra.

Top Paracetamol Exporters and Importers Driving Global Trade

India’s Paracetamol export ecosystem is led by a combination of legacy pharma giants and agile mid-sized firms that specialize in bulk drug production and international distribution. The following are the top 10 Paracetamol API exporters from India known for global reach and GMP-certified facilities:

| Top Indian Exporting Companies |

|---|

| Granules India Ltd |

| Farmson Pharmaceutical Gujarat Pvt Ltd |

| Sri Krishna Pharmaceuticals Ltd |

| Farmson Basic Drugs Pvt Ltd |

| Meghmani LLP |

| Shubham Pharmachem Pvt Ltd |

| Para Products Pvt Ltd |

| Indosol Exports |

| Jayana Pharma |

| Bhojwani Universal Impex Pvt Ltd |

On the importing side, major pharmaceutical buyers such as GlaxoSmithKline Dungarvan Ltd, Granules USA Inc, Johnson & Johnson Consumer Inc, and Glaxo Wellcome SA are key clients, emphasizing India’s trusted role as a global API source.

Top Destination Markets for Indian Paracetamol Exports (2025)

India’s export network spans over 70 countries, with strong penetration in both regulated and semi-regulated markets. Europe, Africa, and Southeast Asia collectively account for more than 60% of total exports. The table below highlights India’s top destination countries for 2025:

| Country | Revenue (USD) | Volume (KG) | Avg. Price per KG (USD) |

|---|---|---|---|

| France | 13,306,301 | 2,465,550 | 5.39 |

| Ireland | 8,840,765 | 1,732,878 | 5.10 |

| Nigeria | 8,311,205 | 2,691,000 | 3.09 |

| Indonesia | 6,959,575 | 1,872,700 | 3.71 |

| Japan | 5,967,645 | 721,600 | 8.27 |

High-value destinations such as Japan and France underline India’s adherence to international standards, while developing markets like Nigeria and Indonesia reflect India’s affordability advantage in the global OTC segment.

Industry Insights, Market Correlations & Growth Drivers

Paracetamol exports are closely aligned with the growth of related analgesic and anti-inflammatory APIs, including Ibuprofen, Diclofenac, Tramadol, and Aceclofenac. The synergistic demand for these molecules ensures steady API utilization across therapeutic categories.

Other major growth drivers for India’s Paracetamol exports include:

- Regulatory Strength: Widespread adherence to USFDA, EMA, and WHO-GMP norms ensures international credibility.

- Cost Leadership: India’s large-scale bulk drug clusters reduce production costs, enabling competitive global pricing.

- R&D and Innovation: Continuous improvement in crystallization processes and impurity control for higher purity grades.

- Supply Chain Integration: Strong domestic raw material sourcing and logistics support enhance timely deliveries.

According to market analytics India’s Paracetamol API segment is projected to maintain a compound annual growth rate (CAGR) of 6–8% through 2026, supported by expanding formulation exports and increasing domestic capacity utilization.

Future Outlook – Strengthening India’s Leadership in Global API Exports

Looking ahead, the Indian Paracetamol export sector is expected to continue its upward trajectory. Government initiatives under “Make in India” and the Production Linked Incentive (PLI) Scheme for bulk drugs are reinforcing India’s manufacturing independence and encouraging investments in API parks.

Furthermore, exporters are increasingly focusing on sustainable manufacturing practices, including solvent recovery, green chemistry, and renewable energy integration. These advancements not only ensure environmental compliance but also position India as a responsible and reliable global supplier.

For data-driven insights, real-time trade statistics, and verified shipment records, professionals can explore the

UN Comtrade Global Trade Database — one of the world’s most trusted platforms for international import-export analytics.

In summary, India’s Paracetamol API exports demonstrate the nation’s continued strength in global healthcare trade — combining scalability, quality assurance, and market intelligence to meet growing worldwide demand in 2025 and beyond.

Strengthen Your Pharma Trade Decisions Today

Strengthen your understanding of India’s Paracetamol export ecosystem with concise, data-backed insights on market trends, pricing shifts, and global demand. Stay updated with reliable trade intelligence, assess exporter strengths, and identify key growth markets to support strategic decision-making in the evolving pharmaceutical API landscape.