-

-

- Indonesia

- United States

- Hong Kong

- Puerto Rico

- Jordan

-

These regions signal rising interest from both regulated and emerging markets, highlighting India’s strength as a sustainable and strategic API supplier.

This article provides an in-depth analysis of Metformin HCl Export from India between 2015 and September 2025, covering export performance, destination markets, price variations, and sustainability trends.

Metformin HCl Export Trends (2015–2025): Growth, Volume & Price Insights

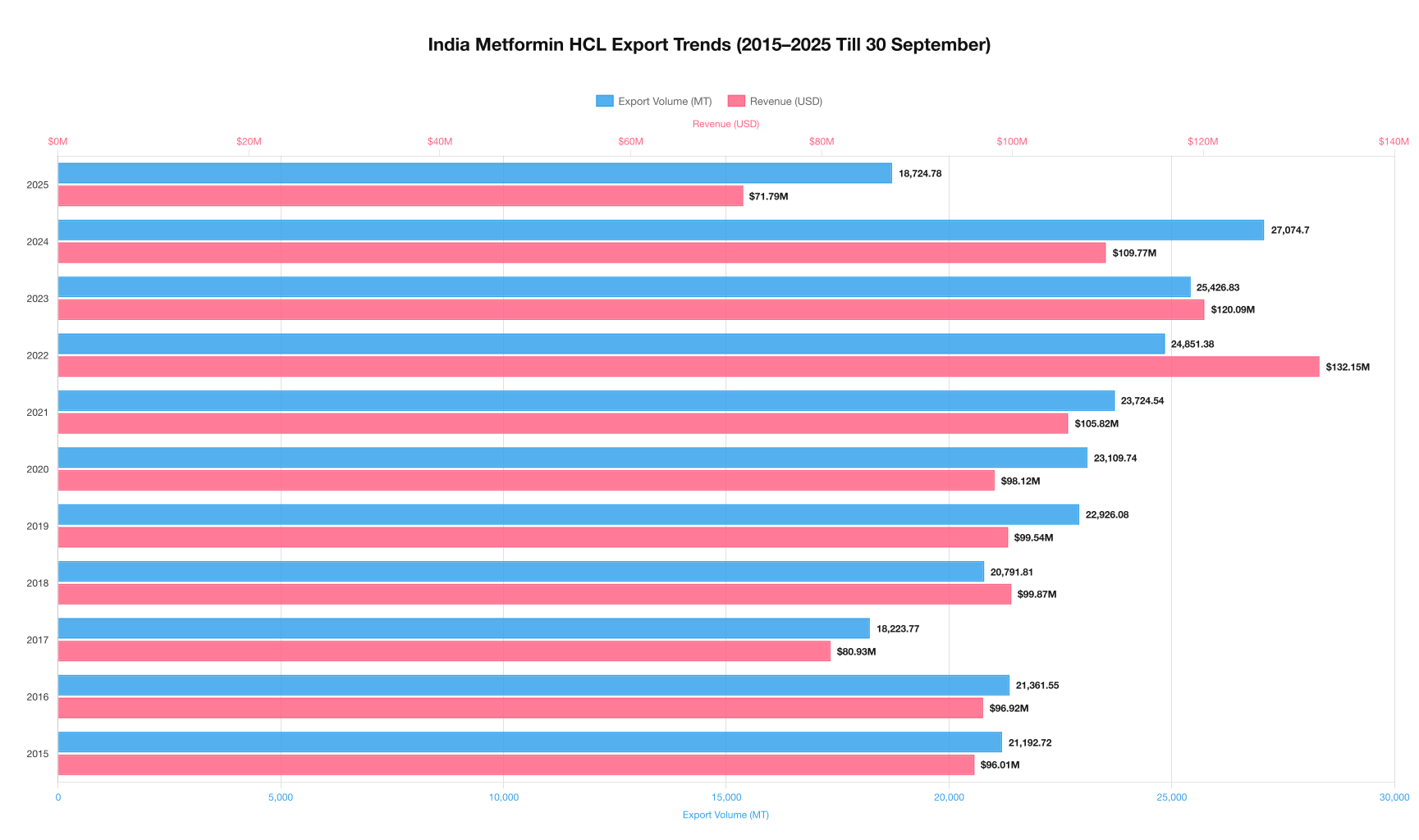

India’s Metformin HCl exports have shown steady growth in both volume and value. Annual production volumes consistently exceed 18,000 MT, while 2024 marked an all-time high of 27,074.70 MT.Between 2015 and 2025, exports under HS Code 29252990 grew at an estimated CAGR of 6.8%, supported by rising demand from Latin America and Southeast Asia.

While export quantity rose significantly, revenues were influenced by unit price fluctuations. In 2022, exports reached USD 132.15 million — largely price-driven. In contrast, the 2024 boom was volume-led, reflecting lower production costs and growing affordability programs worldwide.

Key Takeaways:

- Export volumes surpassed 18,000 MT every year since 2018.

- 2024 was the highest-export year on record with over 27K MT.

- Revenue trends align closely with average export pricing.

Top Metformin HCl Exporters from India

The Indian Metformin HCl export ecosystem is anchored by a diverse mix of large-scale generic manufacturers and specialized API producers. These companies collectively ensure consistent global supply, regulatory compliance, and innovation in formulation-grade quality. Below is an overview of the key players shaping India’s Metformin HCl export landscape:

WANBURY LTD stands out as one of India’s largest producers of Metformin HCl by export volume. The company focuses primarily on mass-market generic API supply, catering to both domestic formulators and overseas buyers in emerging and regulated markets. Its strong production base and economies of scale allow it to maintain competitive pricing while meeting large bulk orders consistently.

USV PVT LTD combines high production capacity with stringent quality standards. As a premium and volume segment exporter, USV operates WHO-GMP and US-FDA certified facilities, making it a trusted supplier to regulated markets across Europe and North America. The company’s strength lies in producing both active ingredients and finished formulations, enabling end-to-end integration across the pharmaceutical value chain.

HARMAN FINOCHEM LTD is recognized for its specialization in custom formulation-grade APIs. Unlike high-volume exporters, Harman focuses on tailored product variants that meet specific regulatory or formulation needs of global clients. Its flexible production model and emphasis on purity and consistency make it a preferred partner for specialized and contract manufacturing arrangements.

AARTI DRUGS LTD has positioned itself as a sustainable and scale-oriented manufacturer. The company’s green manufacturing initiatives and investments in process optimization highlight its commitment to environmental responsibility. With a steady export base across Latin America, Asia, and Africa, Aarti Drugs continues to expand its footprint through diversification and technology upgrades.

IOL CHEMICALS & PHARMACEUTICALS LTD operates as a diversified pharmaceutical and chemical exporter with a strong Metformin HCl portfolio. The company’s broad international presence spans multiple therapeutic categories and export destinations, helping stabilize revenues amid pricing fluctuations. Its integrated operations—from intermediates to APIs—offer resilience and reliability to international buyers.

Collectively, these exporters reflect India’s dual strengths in scale-driven manufacturing and regulatory adaptability. Large players maintain consistent global supply chains, while niche manufacturers are gaining ground by offering customized grades, regulatory agility, and sustainability-led innovation.

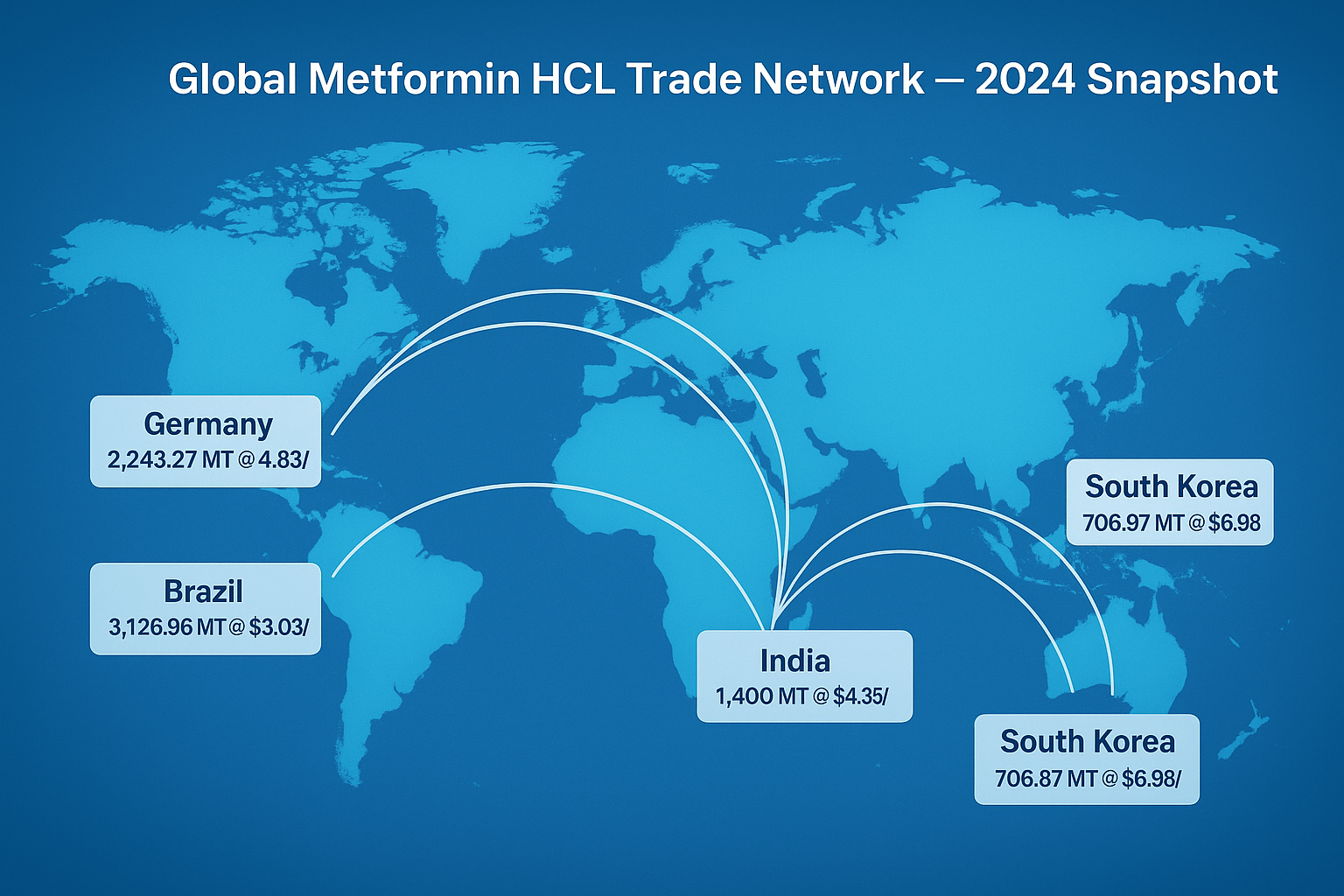

Top Destination Markets and Pricing Overview

Metformin HCl Export from India caters to a wide network of global buyers — from cost-driven economies to regulated premium markets.

| Destination Country | Export Volume (MT) | Avg. Price (USD/kg) | Market Type |

|---|---|---|---|

| Brazil | 3,126.96 | 3.03 | Price-sensitive |

| Germany | 2,243.27 | 4.83 | Regulated |

| Turkey | 1,797.18 | 4.34 | Mid-range |

| Netherlands | 1,266.40 | 7.09 | Premium |

| South Korea | 706.87 | 6.98 | Premium |

The data shows clear segmentation — Brazil and Turkey emphasize cost efficiency, while the Netherlands and South Korea represent compliance-focused, higher-value markets.

On average, India’s Metformin HCl export price ranges between USD 3.0–7.1/kg, positioning it as one of the most competitively priced API exporters globally.

As per HS Code 29252990 data, total export quantity in 2025 reached 363 consignments, with Brazil, Germany, and Turkey emerging as top trade partners by both volume and value.

Key Takeaways:

- India’s exports are diversified across both cost-sensitive and premium buyers.

- Certifications like WHO-GMP, US-FDA, and EMA boost global acceptance.

Metformin HCl Export Price Drivers and Sustainability

The 2024–2025 period saw stabilized Metformin HCl export prices due to improved logistics, lower raw material volatility, and better energy efficiency across plants. Many exporters are transitioning toward ESG-compliant production using renewable power and wastewater treatment systems.

Key Insights:

- Stable logistics costs reinforced India’s competitive pricing edge.

- Eco-friendly practices are now influencing global procurement decisions.

Risks, Opportunities & Strategic Roadmap

Heavy reliance on imported raw materials and regulatory delays pose supply-side risks. Disruptions in feedstock availability can impact export volumes.Between FY22 and FY24, India’s Metformin HCl exports grew by over 18%, reflecting strong resilience despite global price corrections.

Opportunities:

- Upgrading to international certifications like EMA and WHO-GMP.

- Offering regulatory documentation and support to strengthen buyer trust.

- Leveraging sustainability credentials to gain procurement preference.

Strategic Recommendations: Indian exporters should diversify sourcing, enhance ESG transparency, and expand digital traceability to maintain export growth momentum.

Conclusion: The Future of Metformin HCl Export from India

Metformin HCl Export from India continues to anchor global diabetes treatment supply chains. With 427 exporters, multi-continent buyers, and ongoing sustainability integration, India’s API sector is positioned for steady growth through 2030.

To explore verified exporter data and compliance reports, visit: Pharmexcil and PharmaCompass.

Discover Actionable Metformin HCL Market Insights

Explore live data dashboards, uncover real-time export movements, and transform raw trade statistics into strategic opportunities with our intelligent API analytics platform.