Sourcing Snapshot: Import Volumes & Pricing (2015–2025 Till 30 September)

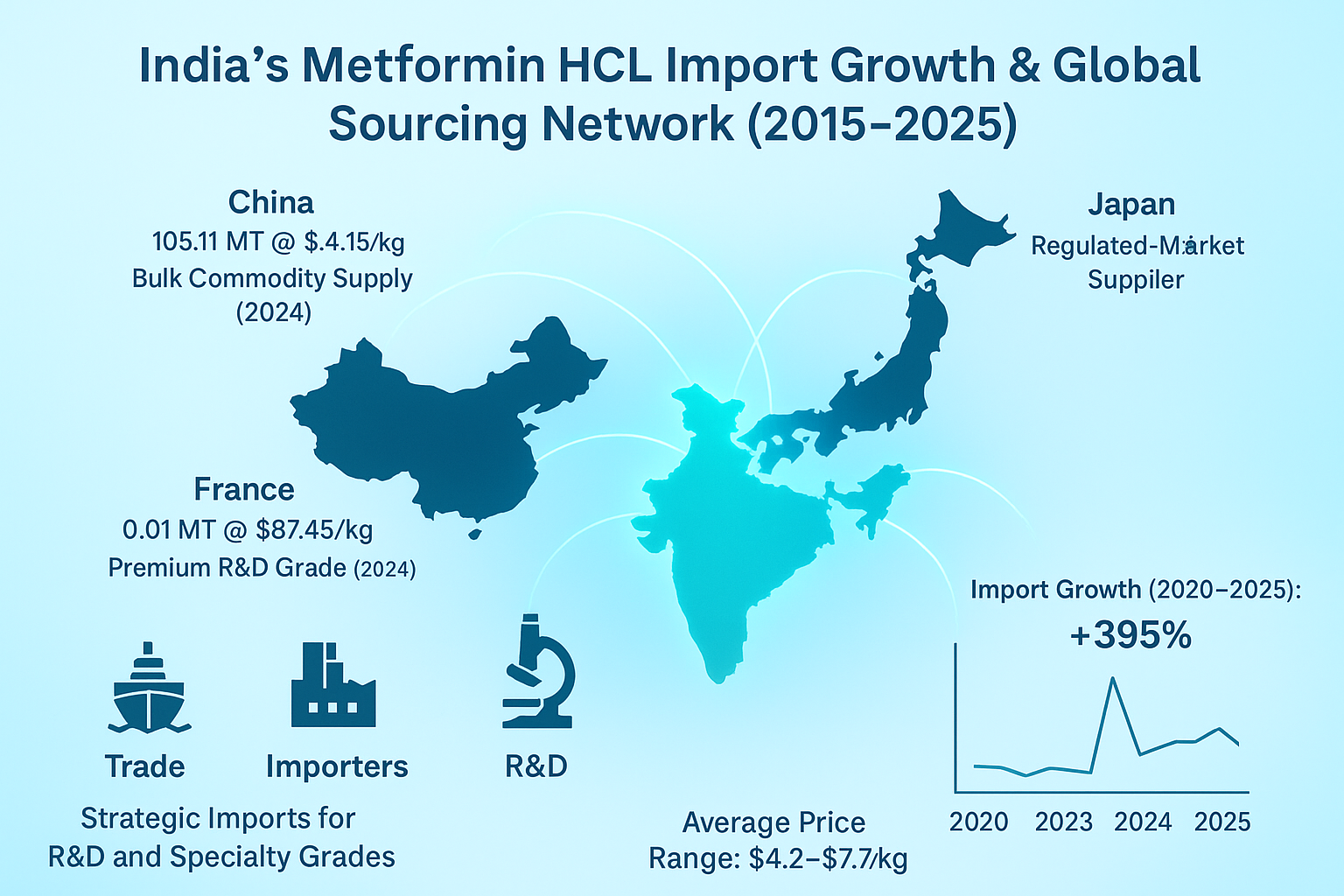

India’s Metformin HCL import activity, though modest compared to its export scale, plays a vital role in ensuring the availability of high-quality technical and pharmaceutical grades for domestic formulation. Over the past decade, India’s imports have reflected a balance between cost-efficient bulk sourcing and strategic procurement of premium grades required for regulated-market products and R&D activities.

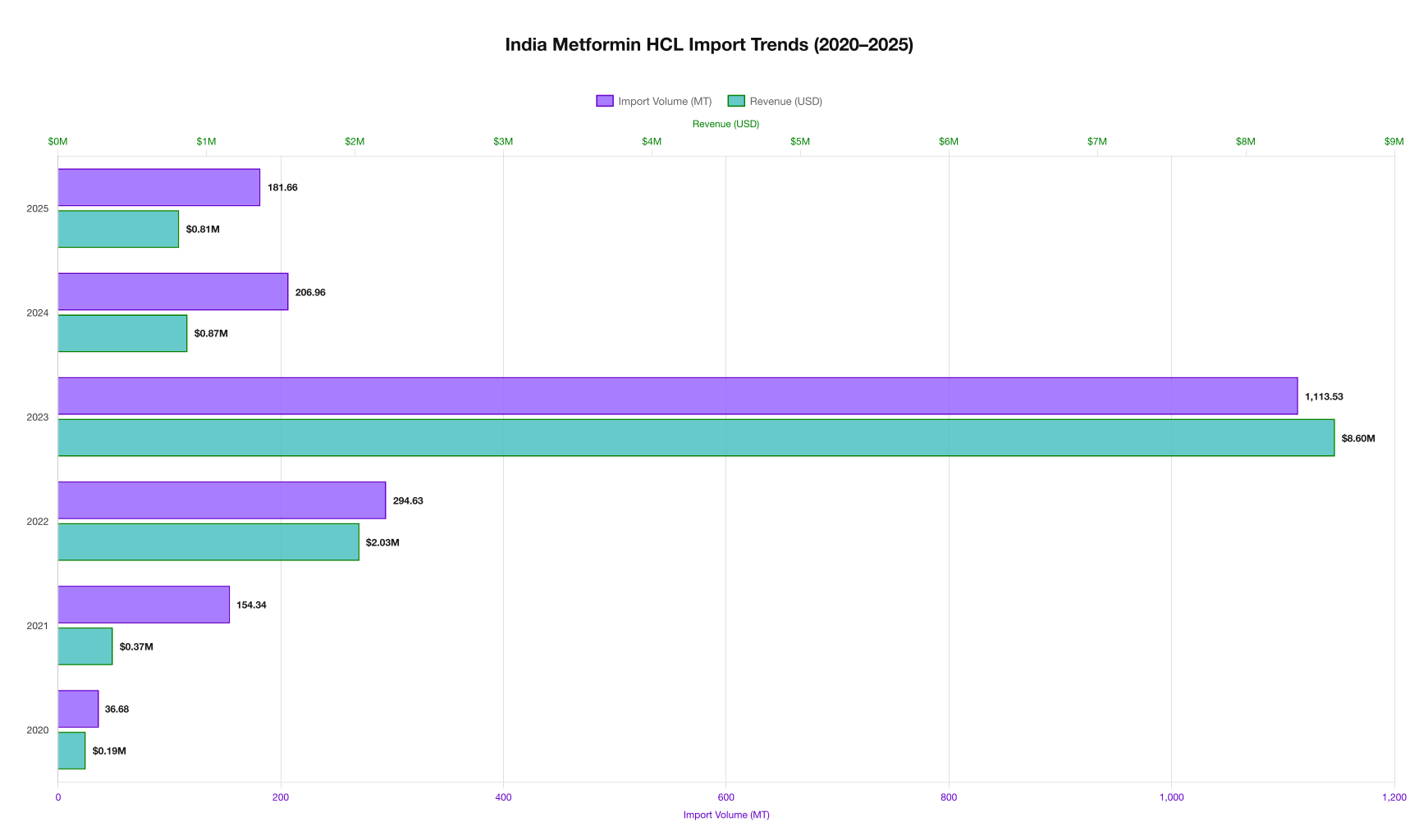

The import trend data from 2020–2025 shows significant year-on-year variability in both volume and pricing. This variation mirrors the cyclical procurement behaviour of formulation manufacturers, who typically purchase large volumes during periods of global price stability and reduce imports when domestic production meets short-term demand.

The year 2023 stands out as a pivotal point, with imports peaking at 1,113.53 MT — nearly a fivefold increase from 2022 — and an average price of $7.72/kg. This surge suggests the procurement of specialised, higher-grade API batches, likely to support exports of finished formulations to regulated markets (U.S., EU) or to back clinical trial supplies. Such spikes are often triggered by global supply imbalances, price arbitrage opportunities, or pre-qualification requirements by multinational partners.

In contrast, imports during 2024–2025 have stabilized both in volume (~200 MT annually) and average price range ($4.2–$4.5/kg), signaling a return to routine sourcing. These years likely represent cost-optimized restocking phases dominated by bulk commodity-grade imports from China, aligning with predictable domestic consumption and steady API demand for generic formulations.

Key Takeaways:

- India’s import activity is cyclical — peaking during premium-grade sourcing years (e.g., 2023) and stabilizing during cost-focused years (2024–2025 till 30 September).

- Fluctuations in import prices reflect shifts in supplier mix, grade specifications, and global market availability.

- Strategic imports play a key role in maintaining supply resilience, formulation diversity, and quality consistency for regulated exports.

Top Foreign Exporters & Indian Importers — Partnership Map

India’s Metformin HCL import ecosystem reflects a blend of cost-driven sourcing and quality-focused alliances. While China dominates the commodity-grade segment, high-specification and regulatory-compliant materials often come from Japan and the European Union. These international partnerships ensure consistent access to both bulk and niche-grade APIs, aligning with India’s growing emphasis on formulation diversity and global compliance.

Notable Foreign Exporters (Supply Sources)

- SUMITOMO PHARMA CO LTD — A Japan-based innovator renowned for its strict adherence to ICH-GMP standards. Supplies high-purity API grades that support formulation R&D and regulated-market manufacturing.

- SHOUGUANG FUKANG PHARMACEUTICAL CO LTD — One of China’s leading API manufacturers, contributing significant volumes of commodity-grade Metformin HCL for domestic blending and downstream formulation.

- MERCK SANTE SAS — A French pharmaceutical company focusing on premium and research-grade APIs, ensuring consistency for European and Indian formulators targeting regulated markets.

- TEVA PHARMACEUTICAL INDUSTRIES LTD — A globally integrated generics and API leader. Supplies India’s contract manufacturers with reliable, large-scale quantities under strict quality frameworks.

- SUMITOMO DAINIPPON PHARMA CO LTD — Specializes in advanced-grade APIs and technical collaborations, offering joint development opportunities with Indian firms for next-generation diabetes treatments.

Leading Indian Importers (Domestic Formulators & Contract Manufacturers)

- HETERO DRUGS LTD — Among India’s largest vertically integrated pharmaceutical players, importing regulated-grade Metformin HCL for both export formulations and chronic care products.

- KEMWELL BIOPHARMA PVT LTD — A global CDMO with European partnerships; sources specialty APIs for formulation development and bioequivalence studies.

- MARKSANS PHARMA LTD — Operates in over 50 countries and leverages imports for differentiated dosage forms, ensuring stable supply for semi-regulated markets.

- CENTAUR PHARMACEUTICALS PVT LTD — Focuses on value-added formulations and quality-driven imports to strengthen its position in domestic therapeutic segments.

- SANDOZ PVT LTD — The Indian arm of the global generics network, ensuring high-quality Metformin sourcing through well-established European and Japanese channels.

These partnerships extend beyond simple purchase transactions — they are often structured as long-term collaborations involving quality audits, technology transfers, and process optimization initiatives. Japanese and European exporters, in particular, play a crucial role in upgrading process validation and documentation standards within Indian manufacturing.

Additionally, such cross-border relationships help Indian companies meet stringent regulatory expectations from authorities like the U.S. FDA and the European Medicines Agency (EMA). These collaborations ultimately strengthen India’s pharmaceutical resilience by ensuring access to consistent, compliant, and high-quality raw materials.

Country-Level Sourcing: China & France (2024 Snapshot)

2024 sourcing highlights are skewed toward China (volume) and an exceptional small import from France (high unit price). These two data points illustrate two distinct use-cases: routine commodity sourcing and one-off premium-grade procurement.

| Country | Quantity (MT) | Price ($/kg) | Use Case |

|---|---|---|---|

| China | 105.11 | $4.15/kg | Bulk commodity sourcing for generics |

| France | 0.01 | $87.45/kg | High-purity or specialized R&D grade (one-off) |

China supplies the bulk of routine API imports — cost-effective and volume-oriented. The tiny France import at a very high unit price likely represents a specialized or pharma-grade sample or a contract R&D order. This pattern underscores India’s strategy: source bulk volumes where cost matters and import premium grades when regulatory or formulation needs demand.

Pricing Drivers, Quality Tiers & Market Signals

Several variables influence import prices and procurement choices:

- Grade & specification: Standard commodity-grade API (used in generics) trades at lower unit prices; high-purity or clinical/R&D grades command significant premiums.

- Supplier certification & provenance: Japanese and European suppliers often command higher prices due to stringent manufacturing standards and traceability.

- Logistics & batch size: Small sample imports (like France’s 0.01MT) yield very high per-kg costs due to fixed logistics and small-batch premiums.

Procurement teams should therefore segment purchases into: (a) volume-driven bulk sourcing, (b) premium-grade specialized buys, and (c) occasional R&D/sample procurement. Building supplier panels that cover each segment allows better cost control and technical flexibility.

Strategic Partnerships and Procurement Recommendations

India’s import activity for Metformin HCL is not merely a fallback to domestic supply — it’s a strategic tool. Imports enable:

- Access to specialty grades for advanced formulations and clinical trials.

- Technology and quality transfer through audits and supplier collaborations.

- Supply diversification to avoid single-supplier concentration risk.

Recommendations for Indian importers and formulators:

- Maintain a multi-tier supplier panel: one for cost-volume (China, other commodity suppliers), one for premium/regulatory-grade (Japan, EU suppliers), and one for R&D samples.

- Use contract terms that include quality KPIs and remediation clauses — especially important when importing from smaller foreign firms.

- Invest in incoming API testing capabilities to validate high-price samples and avoid quality-related supply disruptions.

Key Takeaways:

- Balance cost and quality by segmenting procurement strategies.

- Strategic imports drive innovation and fill gaps in domestic supply for niche formulations.

Conclusion

India’s Metformin HCL imports, though smaller in volume than exports, serve strategic needs—supplying premium grades, enabling formulation diversity, and facilitating global partnerships. With a clear supplier map (China for bulk, Japan/Europe for premium) and strong domestic importers (Hetero, Kemwell, Marksans, Centaur, Sandoz), India can balance cost and innovation by maintaining a diversified procurement strategy.

For further reading on pharma import-regulation expectations, suppliers and buyers can consult the U.S. FDA and European Medicines Agency (EMA) guidance pages.

Unlock Live Metformin HCL Sourcing Intelligence

Monitor supplier reliability, compare grade-level prices, and identify partnership opportunities with instant dashboards tailored for API procurement teams. Start a trial to convert raw trade data into sourcing advantage.